By: Michael Allbee, CFP®, Senior Portfolio Manager

The most popular estate plan is doing nothing. In fact, according to USA Today, 55% of Americans with children die without a will (known as dying “intestate”). However, if you have not done your own estate plan, the probate code has one for you. Probate is a court-supervised process with the courts following state statutes at death to validate the will (if any), appoint a representative, take care of the decedent’s financial responsibilities, and distribute assets to heirs or beneficiaries. Obviously, you may not like their plan. In addition, probate is very costly, time consuming, and it is public record. By having an estate plan, you opt out of the default plan.

A complete estate plan is typically built around some key documents: a will, trust, durable power of attorney, advance health care directive. At a bare minimum, we recommend having a last will and testament to communicate your final wishes pertaining to how your assets are distributed, to identify a guardian for your minor children, and to identify the executor of your estate. Importantly though, a will won’t avoid probate since the court decides if a will is valid (in CA estates with a value of $166,250 or less may qualify for a non-formal probate case – each state has different rules).

Most people opt to have an estate planning attorney draft their last will and testament, however, there is no requirement that an attorney do so. But we often see these 5 mistakes in layman-drafted documents (1):

- No Inclusion of Your Family Tree – The court will want to know your nearest heirs, particularly if you are estranged from them, since the court assumes they are the most likely parties to contest your will. If a close family member is being disinherited, make sure to state it in the will.

- Leavings Assets to Minors – Minors cannot own substantial funds in their own name and a court would be required to hold a guardianship or conservatorship proceeding.

- Naming Too Few or Too Many Executors – If you name only one executor and he/she cannot serve (due to inability, disinterest or his/her own death) your beneficiaries may wait a very long time for the court to appoint another executor. If you name too many people to serve at one time you risk them disagreeing with one another or not coordinating effectively. You should attempt to name the most trustworthy and capable person(s) you can think of to serve as executor(s).

- Incorrect Will Execution – Wills require your signature (or someone signing for you at your explicit direction and in your presence) at the end of the will in front of two disinterested witnesses. The witnesses cannot be beneficiaries of your estate. And they may need to sign an affidavit in front of a notary. Failing any of these steps may cause your will to be invalidated. Just so everyone is clear: An unsigned copy of a will is 100% useless and won’t be admitted to probate.

- Misplacement of the Original Will – You need an original, signed will, particularly if you try to draft your own document. If an attorney drafted the will and it is subsequently lost, the drafting lawyer can sometimes verify a signed copy of the original will in a court during a lost will proceeding. Most states don’t allow these proceedings if no drafting attorney can be found, so when you lose your original will there is no one to question to prove its validity.

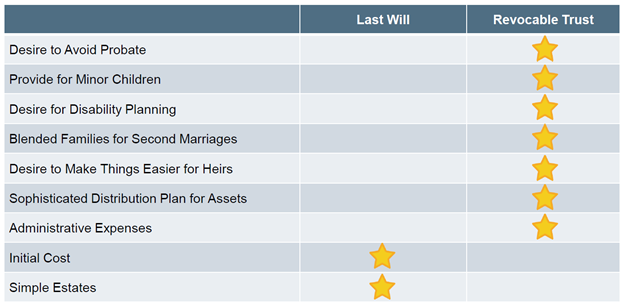

A trust is another method of estate transfer and only a trust can skip probate court. Learn more about how trusts can help carry out your wishes, protect and control your assets after your lifetime by watching this short video here. Here is a summary of differences between a Last Will and Revocable Trust.

Whether you choose a will or a trust, you should seek professional advice. As always, our team of CERTIFIED FINANCIAL PLANNERS™ stands ready to assist: financialplanning@bfsg.com.

- Source: The Kiplinger Washington Editors. Distributed by Financial Media Exchange.

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s web site or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please see important disclosure information here.