We recently have seen a dramatic shift in interest rates in response to the ongoing global crisis. Over the last month, we have seen the 10-year treasury drop from 1.88% on January 1st to 0.81% on 3/12/20.

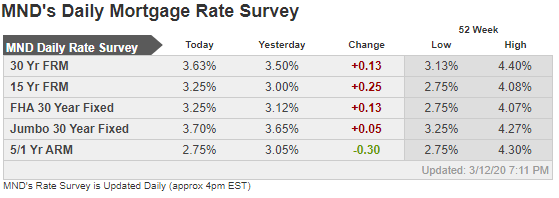

This is important to note because historically mortgage rates tend to move with the 10-year treasury. With the recent drop-in rates, it is logical to assume now would be an excellent time to refinance. While that certainly can be the case depending on when you got your mortgage or last refinanced, but unfortunately rates have not come down as you might have suspected. Recently we have seen mortgage rates essentially break up with the 10-year treasury for the time being as they have chosen to not really go any lower. Mortgage rates continued a relentless surge higher.

The recent decoupling has occurred for a couple of reasons. Mortgages have costs associated with them so that limits how low rates can go, and the mortgage market is currently over-supplied. Like anything else, a rampant excess of supply puts downward pressure on prices. When we’re talking about bonds or mortgages, lower prices mean higher rates and it’s really that simple. The investors that ultimately buy the mortgage debt created by new refinances have been so overwhelmed with the available supply on the market that sellers have desperately lowered prices in order to find buyers. And again, lower prices on mortgage debt mean higher rates for consumers.

Should you consider a refinance? If you have not refinanced in the last couple of years now may be a good time to investigate a refinance and see if it makes sense. Another reason to consider a refinance is to switch from a 30-year mortgage to a 15-year or 20-year mortgage. This can help save years of payments potentially and the payment may not increase as much as you might think. Please contact us if you would like us to review your current situation or if you would like a referral to someone that can help you with refinancing.