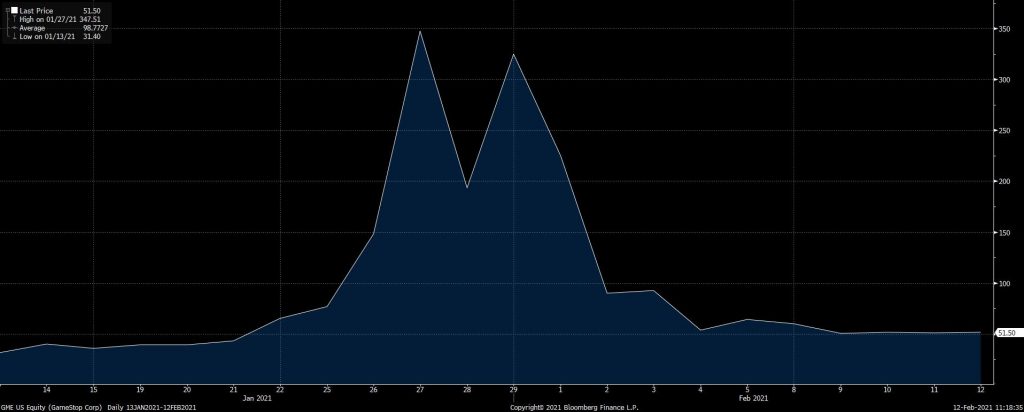

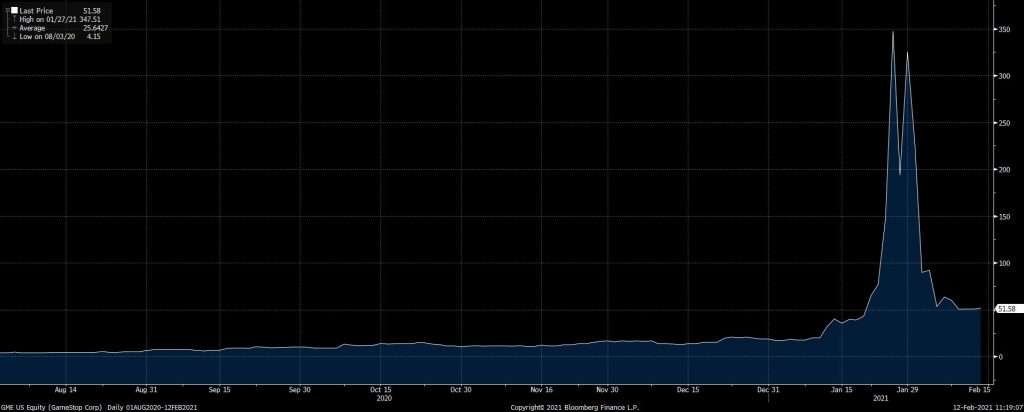

The WallStreetBets subreddits members making their YOLO bets with their stimies on GameStonk are asking; “Where are my tendies now”? Don’t ask if you didn’t understand that sentence but just look at these charts of GameStop (GME).

If you didn’t get a chance to see the “Coffee with Dr. Steve and Katie” we posted last week, check it out here. We discussed GameStop in more detail.

Ben Graham, who many consider the “father of value investing” and who wrote the classic The Intelligent Investor, said, “The typical experience of the speculator is one of temporary profit and ultimate loss”. This holds even truer for those who joined the excitement later and are now facing large losses as the stock plummeted.

Charles Kindleberger, in his book Manias, Panics, and Crashes, laid out the five stages of an asset bubble:

- Displacement: Some kind of catalyst occurs that is recognized by early investors (i.e., the “smart money”) which causes them to start investing in an industry, country, or theme.

- Boom: The narrative supporting the investment gains traction, and momentum grows.

- Euphoria: The media begins covering the investment more broadly, and everyone becomes aware of this compelling opportunity. In the 1990s, it was cab drivers investing in internet stocks; today, it is contractors investing in bitcoin and Instacart drivers investing in Gamestop. Momentum rises dramatically.

- Crisis: Early investors start to get out. The selling gains momentum as more investors exit the investment as prices move lower. The bubble bursts and “euphoria buying” is replaced by “panic selling.”

- Revulsion: Media coverage becomes broadly negative, the asset becomes very unloved, and it can fall to irrationally low levels.

It appears we are in stage 4 (crisis) of this asset bubble with GME and watch-out for stage 5 (revulsion). The huge price swings had little or nothing to do with the actual value of the company (and many of the other stocks caught up in the trading frenzy). GME and some of the companies will need to make fundamental business changes to address the underlying weakness that caused them to be targeted for short sales in the first place or they will go out of business. Remember that creative destruction is good for the long-term well-being of the economy.

As an investor, the lesson for you might be to tune out market mania over “hot stocks,” especially when there is little to back up the sudden interest other than speculation. The wisest course is often to build a portfolio that is appropriate for your risk tolerance, time frame, and personal situation and let your portfolio pursue growth over the long term. This strategy may not be as exciting as the wild ups and downs of stocks in the spotlight, but it’s more likely to help you reach your long-term goals.

Disclosure:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Benefit Financial Services Group (“BFSG”), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from BFSG. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. BFSG is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of BFSG’s current written disclosure Brochure discussing our advisory services and fees is available upon request.

BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s web site or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please see important disclosure information here.