By: Thomas Steffanci, PhD, Senior Portfolio Manager

On Wednesday, June 23, 2021, the minutes of the Federal Reserve’s (the Fed) latest policy meeting held a week earlier were released along with individual members’ (anonymous) estimates of where the Federal funds rate will be through 2024. The policy setting group (the Federal Open Market Committee) is comprised of 18 members including Chairman Jerome Powell.

The content of the minutes was a “stunner” according to market pundits. Of the 18 Fed officials, 13 estimated that the Fed would likely raise interest rates twice by late 2023, up from 7 members in March. And seven of those 13 members expect interest rates to rise next year vs. three in March.

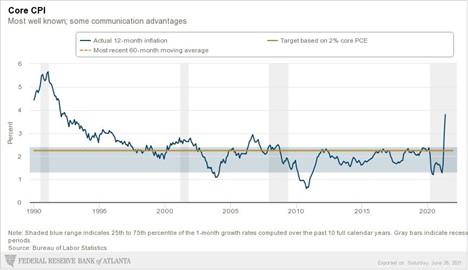

Why the shift? The committee’s average estimate of annual inflation in 2021 was increased from 2.4% to 3.4%. This may not sound like a big deal, but it assumes that inflation is going to run hotter in the remaining months of this year than formerly expected. Undoubtedly, the latest surprising May inflation number of 5% compared to a year ago turned the Fed heads’ March projections to dust for the ensuing 3 years.

The market was caught off guard by these changes. The 10-year Treasury bond yield leapt from 1.48% to 1.60% immediately following the release, and the Dow Jones Industrial Average (the Dow) lost about 300 points and closed lower the next two days. But bond yields wound up getting back to where they were during that two-day period before all this happened. Putting a capstone on this, the Dow is up 3% from its low post-Fed level.

So, the “stunner-in-the-summer” turned out not to be. There have been various reasons given for this. One has it that Chairman Powell harnessed a few fellow members to argue publicly that these estimates are individual member projections which in the past turned out to be wide of the mark. Another was that the committee did not discuss the timing of “tapering” their purchases of Treasury and mortgage securities or the extent of any interest rate changes.

But the markets’ ultimate reaction was more fact-based than that. The Fed’s latest meeting utterances were not “hawkish” at all. Consider this. Inflation has been rising since last June, and yet the Fed has not changed policy one iota. It has been running monetary policy full steam ahead during rising inflationary pressures. Adjusting for inflation, monetary policy has become easier as the real Fed funds rate has fallen from -1.1% to -3.8%. This is the result of their new policy framework not to raise interest rates preemptively but to seek maximum employment and deal with inflation later.

So, appearing to be hawkish to Wall Street know-it-alls, under their new framework the Fed is not going to get ahead of the curve to stem inflation. Even those on the committee who see a higher Fed Funds rate in 2022 are only penciling in a .75% level, a mere half percent higher than the upper Fed range now.

The Federal Reserve told the world and importantly the stock and bond markets that they expect to maintain a negative Fed funds rate for at least the next 2½ years. With the real cost of money an enticingly negative 4% or more, why should the markets give any credence to what the Fed says otherwise? Pay attention to what they do and ignore the rest. That is what the market understood this week.

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s web site or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please see important disclosure information here.