By: Henry VanBuskirk, CFP®, Wealth Manager

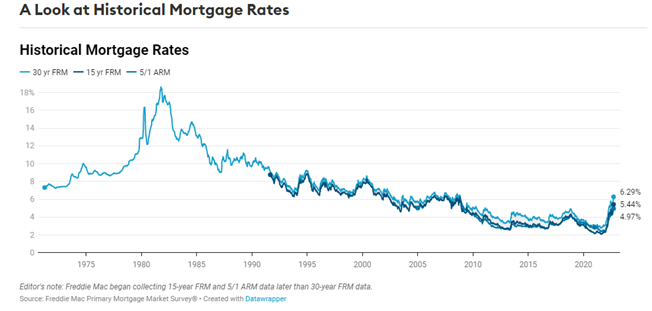

With all of the recent headlines in the news about mortgage rates increasing and waning home affordability, it seems daunting for the first-time home buyer. A 30-year fixed mortgage now exceeds 7%, a level that hasn’t been seen since 2008. That same 30-year fixed mortgage was around 3% just a year ago.

The reality here is that you aren’t going to be getting a 30-year fixed mortgage at 3% from your local bank anytime soon. With that being said, there is one bank that might be willing to loan to you at a rate lower than 7% – The First National Bank of Mom and Dad. What I’m talking about is an intra-family loan, which is a strategy that can be beneficial to both the borrower (a parent, family member, or family friend) and the lender.

Intra-Family Loan Basics

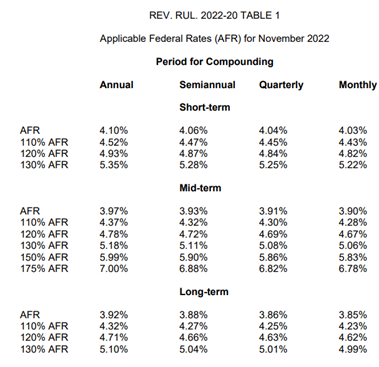

An intra-family loan is a formal agreement between a borrower and a lender. Interest on the borrowed amount must be equal to or greater than predetermined IRS rates that are referred to as ‘Applicable Federal Rates’ (AFRs) and these rates are reset monthly. Here’s the AFR for November 2022:

If we are using the mortgage example, we would want to assume a long-term AFR at a monthly rate (3.85% annually). If we compare this to a mortgage rate of 7%, the AFR looks attractive to the borrower by comparison. The key is that the lender must charge at least the AFR, because if they charge less than that, the IRS will impose their imputed interest rules. Imputed interest is when the IRS believes that the loan is a gift and will instead report the difference between what the AFR is and what the lender charged and make the lender report that difference on the lender’s tax return. As with anything involving the IRS, you want to make sure you are abiding by the rules they set forth and document that you are following those rules.

Consulting with a tax professional and legal professional is recommended before an intra-family loan arrangement is set up. The first step when drafting an intra-family loan is to make sure that you discuss the terms of the loan. Then it is important to draft a promissory note, pledge collateral (i.e., the home), and send out monthly statements of the balance due. We also recommend that an IRS Form 1098 be produced to the borrower for interest paid and an IRS Form 1099-INT be procured to the lender for interest received.

Intra-Family Loan Example

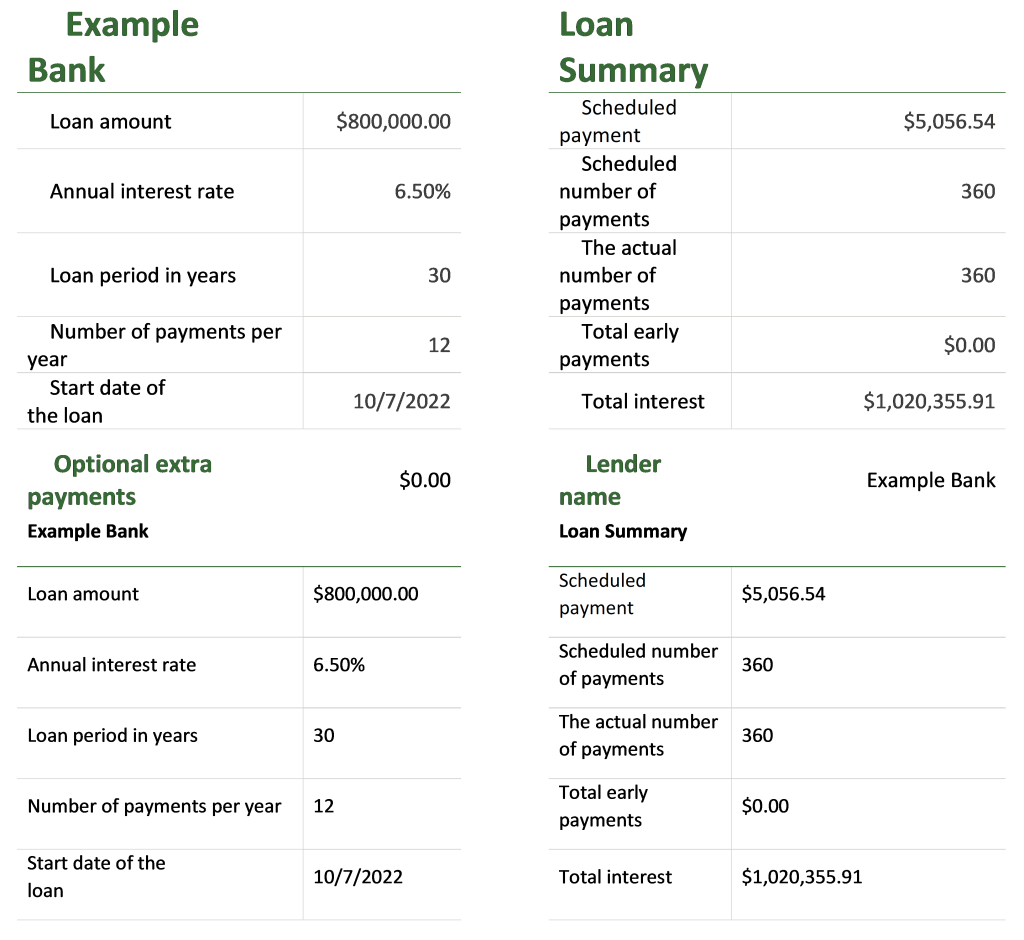

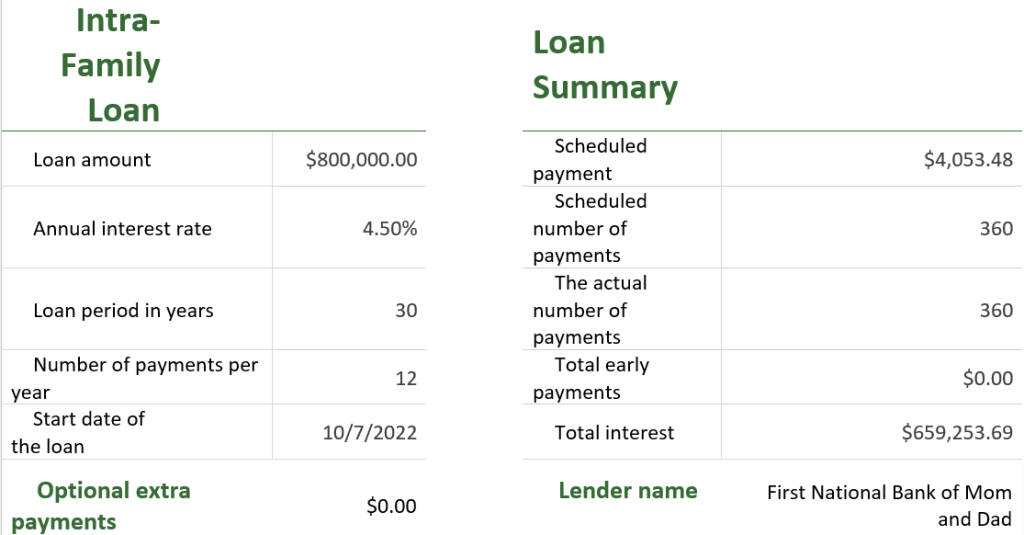

For this example, assume that the borrowers are looking for a mortgage of $800,000 to help with their $1,000,000 home purchase and the bank quotes them a 30-year fixed rate mortgage at 6.5%. Those same borrowers then look to mom and dad, and they are willing to set up an intra-family loan of $800,000 at a rate of 4.5% over 30 years.

Here is what an $800,000 30-year fixed-rate mortgage at 6.5% would amount to:

Now let’s look at the intra-family loan example for $800,000 over 30 years at 4.5% fixed:

The borrower would save $1,000 per month, every month, for 30 years and over $350,000 of interest over the life of the loan.

Other Uses of Intra-Family Loans

Intra-family loans are not just a mortgage alternative. An intra-family loan can also be set up to help the borrower start a small business. It’s a similar argument for the mortgage example, the lender can loan to the borrower at a lower interest rate than the current prevailing interest rates.

For reference, here are the current rates for small business loans from the Small Business Administration (SBA).

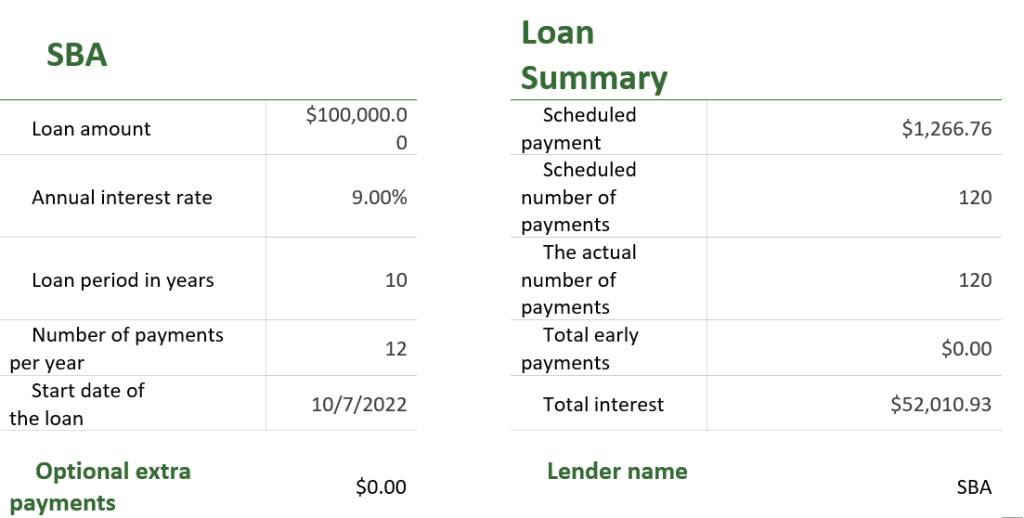

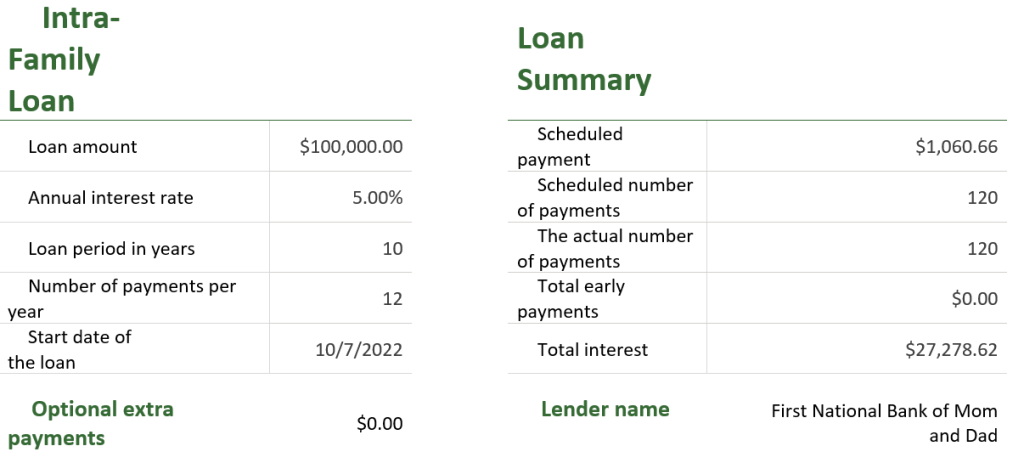

For this example, assume that the borrower wants to start a business and needs to borrow $100,000 to do so. The SBA is willing to loan the $100,000 at a 9% interest rate over 10 years. The borrower’s family member is willing to loan the $100,0000 at a 7% interest rate over 10 years. Here is what the SBA loan details would look like:

Here’s what that same loan would look like at a 5% interest rate:

The borrower would in this example save $200 per month and over $24,000 in interest over the life of the loan by doing an intra-family loan.

What’s in it for the Lender?

So far all of this sounds great for the borrower, but what about the lender? Fortunately, there are benefits to the lender as well. If the lender chooses, they could set up the intra-family loan to be forgiven at the lender’s death. Doing this would decrease the taxable estate of the lender because the heirs would not be required to continue paying the loan to your taxable estate. This means that if your estate is valued above the estate tax exemption and your estate is taxable, then your heirs would not be liable for the tax due on the remaining amount of the loan repayments.

Furthermore, the loan payments can also be made to the lender, where the lender sets up a Trust where the lender is the owner for tax purposes, but not for estate tax purposes. This is called an Intentionally Defective Grantor Trust (IDGT). Assuming that the IDGT is set up correctly, the income taxes would be paid by the lender (not the Trust), which would allow the periodic payments that are being sent to the Trust to grow tax-free. When the lender dies, the assets in the IDGT won’t be included in the grantor’s taxable estate. The intra-family loan would need to be carefully constructed to account for these types of measures and it is recommended that you consult a legal professional.

Another advantage is that if the lender thinks of the intra-family loan interest rate as an income stream to them, they would be receiving an income stream that isn’t tied to the stock or bond market. This could further diversify their investment portfolio. Further, if the borrower turns out to not want to pay you back for whatever reason, the loan is collateralized by the home, small business, or whatever asset the borrower pledged to the lender and you could always just seize the asset that was put up as collateral.

Summary

There are many different ways that an intra-family loan can help both the borrower and the lender achieve their long-term financial goals. We discussed some of these ways, including helping a first-time home buyer purchase a home, supporting a business-owner in starting a business, and how a lender can decrease the size of their estate with careful planning. We are happy to discuss your long-term financial goals with you and help determine if an intra-family loan would be appropriate for your unique situation.

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s website or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please remember that different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy (including those undertaken or recommended by Company), will be profitable or equal any historical performance level(s). Please see important disclosure information here.