By: Tina Schackman, CFA®, Senior Retirement Plan Consultant

The SECURE Act of 2019 provided some much needed legislation to help improve coverage in retirement plans, incentives for small businesses, and additional safe harbors for retirement plan fiduciaries. One area that deserves a closer look is the newly created Section 404(e) of ERISA which provides safe harbor relief for the selection of lifetime income providers. The safe harbor provision under the SECURE Act of 2019 (the “Act”) for defined contribution plans states a fiduciary must undergo an “objective, thorough, and analytical search” to identify a provider for a lifetime income product, but it does not release fiduciaries from all of the risks associated with choosing an income product for their plan. The safe harbor provides relief for the selection of the provider, not the product.

Retirement plan providers offering these products typically only have their own proprietary product on their platform, so what is the likelihood the lifetime income provider or product selected is always going to be with the plan’s current provider? Until retirement plan providers are willing to offer non-proprietary lifetime income products on their platforms, retirement plan fiduciaries are going to be held to a standard of ensuring the product available with their current provider is suitable for their participants, but possibly not the most appropriate product.

In order for retirement plan fiduciaries to fulfill the requirements under the safe harbor relief, there are two requirements that must be met when selecting a lifetime income provider:

1) Verify the Provider Can Meet Their Financial Obligations: A thorough review of the financial capability of the provider must be completed to verify the provider is financially capable of satisfying its obligations under the retirement income contract. This review must be done at the time of selection, and reviewed periodically (e.g., annually). Under the safe harbor, as long as the plan fiduciaries receive written representations from the provider verifying proper licensing, ability to meet state requirements, and undergo routine financial examinations, they can be assured they’ve met this requirement.

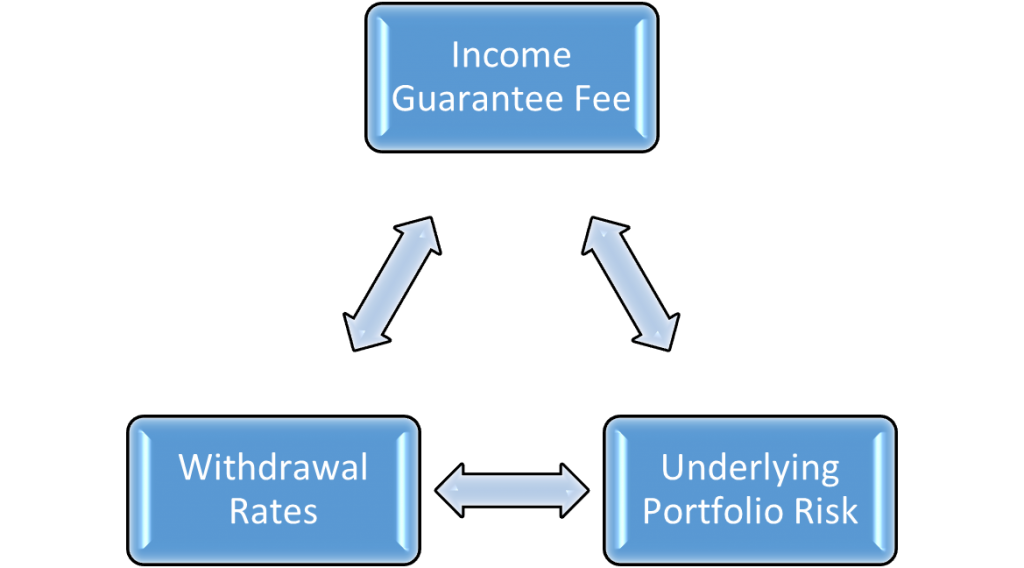

2) Reasonableness of Costs Analysis: Fiduciaries must determine the costs (including fees and commissions) are reasonable for the guaranteed retirement income contract offered by the provider in relation to the benefit and product features (referred to as the “income guarantee fee”). The Act goes on to state there is NO requirement for a fiduciary to select the least expensive option. When conducting this type of analysis, it is important to note the income guarantee fee, withdrawal rates, and risk/volatility of the underlying portfolio are all interconnected. For example, the income guarantee fee is partially based on the cost of hedging the risk of the underlying portfolio, such as a balanced fund. But if your provider’s income solution only offers a very conservative portfolio option, then the income guarantee fee could be expected to be lower than other products with more aggressive portfolios. Alternatively, if the withdrawal rates are lower than other products, it could be argued the income guarantee fee shouldn’t be as high as alternative products. All three of these factors should be considered when reviewing the reasonableness of costs (See Illustration A).

Illustration A

What about portability?

Portability of these products at the plan level and for participants has been an area of concern for fiduciaries because it could have an impact on terminating employees and how the assets would be administered in the event of a termination of a service provider. The Act helps resolve the issue of plan level portability by creating a new “distributable event” that applies to lifetime income products when they are no longer allowed as an investment option within a plan. In such situations, participants will be allowed to distribute their income product in-kind to an IRA rollover product beginning 90 days prior to the elimination of the product as an investment option. If a plan sponsor wants to change retirement plan providers and is not able to transfer the lifetime income product to the new provider, all of the lifetime income assets will be rolled into the previous provider’s IRA rollover product. However, this may make the existing plan less desirable to the new provider, and the income product may be more expensive to maintain for those participants wanting to keep the lifetime income benefit.

As retirement plan fiduciaries continue to explore lifetime income products, many questions may arise around how the distribution phase works, how account balances can continue to grow, how participants can take all their money out of these products, etc. From our experience, the real concerns behind lifetime income products surface when participants begin to execute on the guarantee and draw down the income benefit. Reasonableness of fees and the ability of the provider to fulfill their financial obligations are critical elements of the due diligence process, but it should also be noted there are other areas of potential fiduciary liability that shouldn’t be overlooked and do not have protection under the Act.

BFSG has the expertise to conduct a thorough analysis of lifetime income products, so please contact us if you are interested in a lifetime income product for your retirement plan or you have an existing product and are interested in learning how to obtain safe harbor relief.

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s web site or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please see important disclosure information here.