By: Henry VanBuskirk, CFP®, Wealth Manager

Our team at BFSG has done extensive research on the impact on the average American’s psyche when filing their income tax return and the results of our study concluded that there are two groups of people that don’t like paying taxes…Men and Women.

This article will discuss tax planning from a federal estate and gift tax perspective and in future installments of this 4-part estate planning series, we will discuss strategies that can help reduce your overall income tax burden. If you have concerns regarding how these strategies could affect certain estate and gift planning transactions in which you intend to engage or have previously engaged, please contact your tax advisor and estate planning attorney to further discuss your estate and gift planning inquiries. Our firm is happy to work with you and your estate planning attorney on your unique situation and we can work together to help you achieve your estate planning goals.

Estate Tax

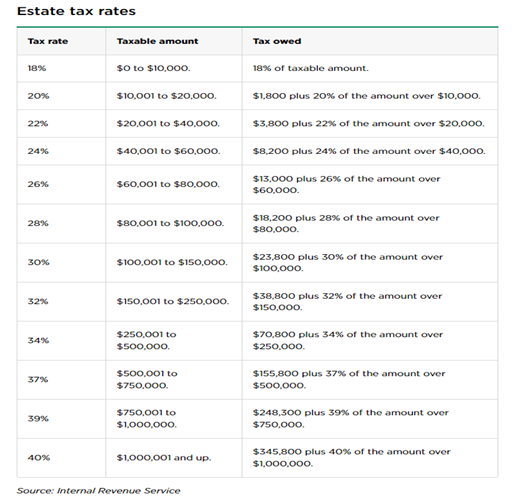

Your gross estate is defined as all your includible property, which may consist of cash and securities, real estate, insurance, trusts, annuities, business interest, and other assets. The federal estate tax is only applicable if your estate at the time of death is greater than $12,060,000 for a single person or $24,120,000 for a married couple. This threshold is called the estate tax exemption. If this exemption is all used up, the remainder of the value of the estate is then taxed as follows:

As you can tell, these estate tax rates start at 18% and climb up to 40% fairly quickly. Here is an example of how the estate tax is calculated for a married couple that has a $50,000,000 estate:

*The unified credit is just what the lifetime federal estate tax exemption translates to when going to calculate your estate tax liability.

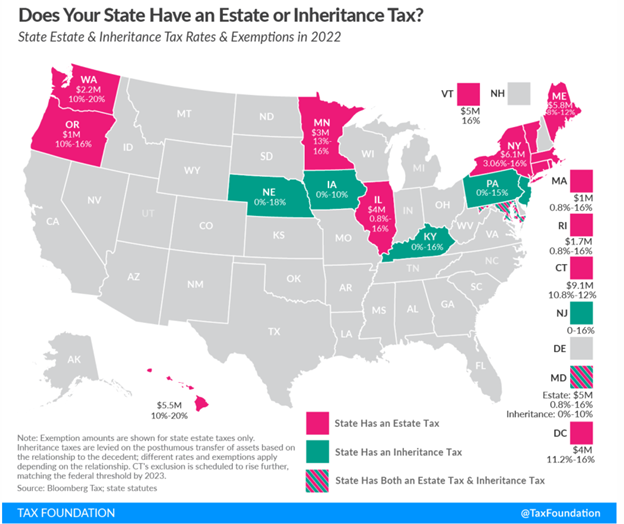

Most states do not impose a state estate tax, unless you live in: Connecticut, District of Columbia, Hawaii, Illinois, Maine, Massachusetts, Maryland, New York, Oregon, Minnesota, Rhode Island, Vermont, and Washington. If you live in one of these states, please check with your state’s taxing authority to confirm your state’s estate tax exemption. In some states, the state estate tax exemption is only $1,000,000. The state estate tax generally ranges from 0.8% – 20%, depending on the size of the estate and what state the estate is in.

Gift Tax

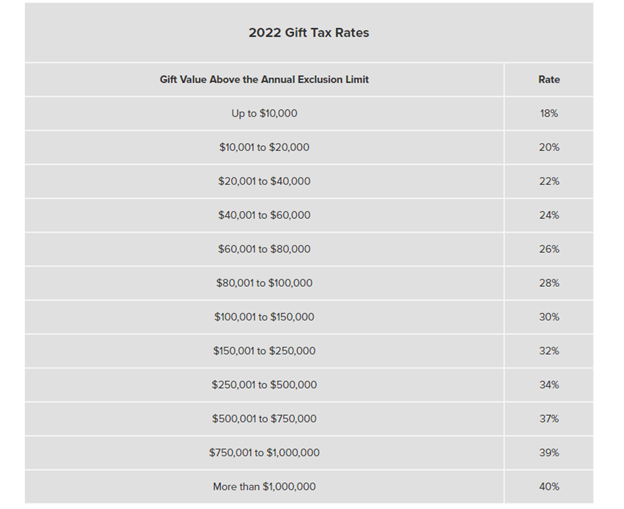

There is also a gift tax that shares the same exemption limits as the federal estate tax exemption. The gift tax rates are the same as the previously mentioned estate tax rates. As reference, here is a chart on the gift tax rates:

The gift tax was put into place so that people who have large estates and looked at the estate tax rates who thought, “We’ll I’ll just gift some of my estate away while I’m alive, so my heirs can avoid some estate taxes when I’m dead….” Unfortunately, Uncle Sam is one step ahead. The gift tax is levied on persons who exceed the annual exclusion of $16,000 per year per beneficiary. However, it is not necessarily the case that you, for example, gift $17,000 in one year and you have a gift tax due of $180 ($1,000 x 18%). You would be able to utilize the federal estate tax exemption limits to lower your lifetime federal estate tax exemption. This means that a single person would instead of having the $12,060,000 or married couple having the $24,120,000, that single person would instead have a federal lifetime estate tax exemption of $12,059,000 and the married couple would have $21,119,000.

Married couples are also able to elect gift splitting, which means that spouses can share their amount that they gifted.

Gift splitting example: Let’s assume the same $17,000 gift is made. The married couple could say that spouse 1 gifted $10,000 and spouse 2 gifted $7,000. Doing this would not lower their lifetime federal estate tax exemption since neither spouse actually gifted more than $16,000 individually. Electing gift splitting would require filing a tax return (IRS Form 709), but no tax would be due.

Inheritance Tax

The last tax I wanted to cover that is applicable to six states is the inheritance tax. Those six states are: Iowa, Maryland, Kentucky, Nebraska, New Jersey, and Pennsylvania. Yes, Maryland has both an inheritance tax and a state estate tax to worry about (sorry people of Maryland). The main difference between the estate tax and the inheritance tax is who is on the hook for the tax bill. The estate tax is paid by the estate, while the inheritance tax is paid by the beneficiary. The inheritance tax generally is progressive and ranges from 0-16% depending on which state you live in. Spouses are always exempt from the inheritance tax, but each state has its own rules on what family members are and aren’t excluded and each state has different thresholds for how much of the inheritance is exempt from taxation (with some states having exemptions only being at $500, $1,000, or $3,500).

For reference, here is a state estate tax or inheritance tax map:

Now that we have our basis covered for what these taxes are and why they exist, I would like to talk about how to mitigate them through different financial planning strategies. The first thing that you might think of with how you would reduce your estate tax bill is to just get some of your assets out of the estate so that they aren’t there after you pass. That is the first type of strategy that I would like to cover in our next installment of this series.

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s website or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please remember that different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy (including those undertaken or recommended by Company), will be profitable or equal any historical performance level(s). Please see important disclosure information here.