By: Henry VanBuskirk, CFP®, Wealth Manager

When you google “Biggest Enemy of Retirement” you will get around 20 million results with answers such as (1) inflation, (2) lower interest rates, (3) higher interest rates, (4) procrastination, (5) taxes, (6) overspending, (7) whatever politician a talking head doesn’t like that day and (8) you. The answers to your questions, “I’ve saved and saved my whole life. How do I retire? Can I ever retire? Do I need to save more?”, can be very daunting to think about and still might be unanswered. This may lead you to continue your google search, leaving you overwhelmed and unsure of where to start. Spending your whole life accumulating and hiking up “Retirement Mountain” might leave you frozen at the summit, not sure how to get down. We don’t want you to spend the rest of your life in fear, ultimately ending up like Preston Blake (pictured above) from the 2003 movie Mr. Deeds.

Our goal is to help you get down “Retirement Mountain” safely and understand the biggest enemies you might face on your descent (the deaccumulation phase). This will tell us what your deaccumulation phase realistically looks like and how you can get there. The most common retirement foes we’ve faced when helping clients over the years are: (1) Taxes and spending, (2) Volatility, and (3) Emotional decision making.

Taxes and Spending

This one might seem obvious, but how much you spend and how much you give Uncle Sam are big indicators of how well your financial future is going to look. If most of your retirement income comes from social security, pensions, and/or annuities, you are mainly on a fixed income. A large unplanned expense (i.e., home maintenance, medical bills, or car repair) can put a damper on your monthly budget, but you still have to get the money to pay for that unplanned expense somewhere. To illustrate this, I have the following example:

Clark and Ellen Griswold have the following sources of income each year:

- Clark’s Social Security – $20,000

- Ellen’s Social Security – $20,000

- Clark’s pension – $10,000

They spend $4,000 per month, live in Florida (no state taxes), and also have the following investment accounts:

- Clark’s IRA – $100,000

- Clark and Ellen Joint Investment Account (JTWROS) – $100,000

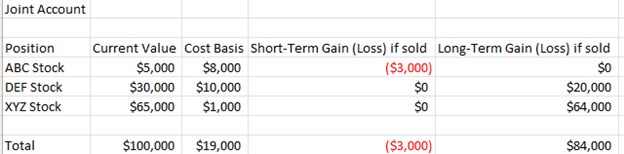

The joint account has the following positions:

They have no other assets.

Clark and Ellen have a sudden roof leak that they need to repair, and it will cost them $35,000.

Clark and Ellen have two options:

Option 1 – Take the money from the IRA

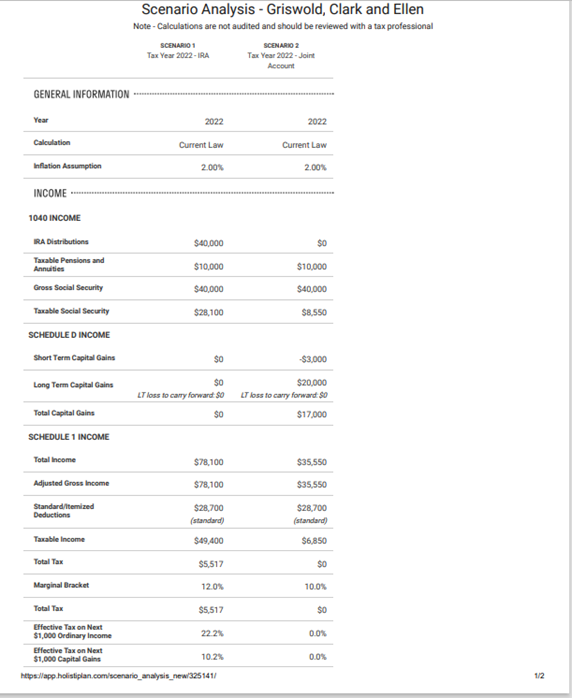

Any distributions received by the IRA owner are taxable at ordinary income when received. They withdraw $40,000 from the IRA, pay $5,517 in federal taxes, and receive a net amount of $34,483. Just enough to pay for the roof repair.

Option 2 – Take the money from the Joint account

As referenced previously, the joint account has ABC stock, DEF stock, and XYZ stock. After talking with our team at BFSG, we recommended that Clark and Ellen sell ABC stock and DEF stock and withdraw $35,000 from their Joint Account. They will realize a short-term capital loss of -$3,000 and a long-term capital gain of $20,000 but actually won’t owe any taxes this year. They were able to keep their IRA intact and pocket tax savings of $5,517. Maybe they should put some of those tax savings in the bank in case of a rainy day. Here is a summary from our tax planning software provider that illustrates the differences between these two scenarios:

Here at BFSG, we abide by Uncle Sam’s rules, but we like to make him work for his money. Uncle Sam is not a charity, so don’t treat him like one.

Another enemy that you will most likely face is volatility, which we are going to tackle next.

Sequence of Returns Risk

Volatility is a topic that we’ve all heard over the news lately and it is usually framed in a negative light, but volatility can also be a positive depending on where you are in your life. If you are a young working professional with 30 years left until retirement, you are able to continue contributing to your 401(k) and history shows that markets tend to go up more than go down. If you’re reading this article, you’re probably closer to retirement than not. How volatility can derail a retirement plan is when distributions from a retirement account occur during a time of bad market returns. A large market loss early into a person’s retirement can dramatically decrease the financial plan’s success. This is referred to as “sequence of returns risk” and is discussed in the following example.

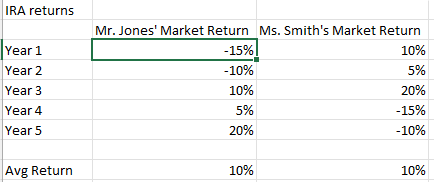

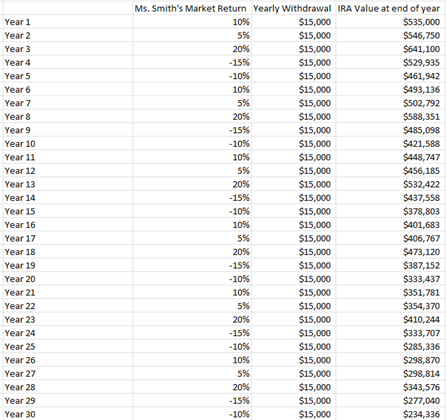

Example: Two clients, Mr. Jones, and Ms. Smith have $500,000 in an IRA and withdraw $15,000 at the end of each year. The IRA returns repeat every 5 years and is illustrated below:

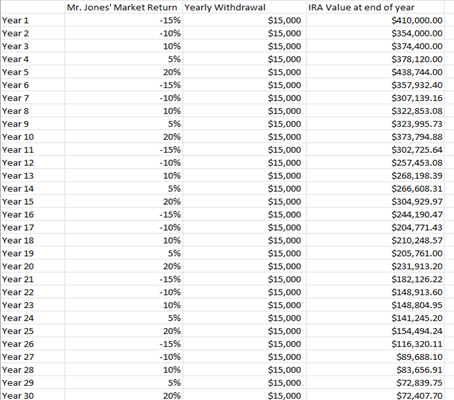

Mr. Jones and Ms. Smith have the same average return. Let’s assume that each client’s retirement lasts 30 years. At the end of the 30 years, Mr. Jones’ IRA is worth $72,407.70 and Ms. Smith’s is worth $234,336. Here is the math behind those figures:

Where we are in a market cycle and where you are in your lifecycle are two variables that we need to clearly understand. If Mr. Jones had a large unplanned expense of $100,000 in Year 27, he couldn’t afford to do it. On the other hand, Ms. Smith most likely could.

If you say that you are an aggressive investor, we may need to dial the risk down if you are retiring next year and we continue to have negative stock market performance. This is where distribution planning becomes important, and we can help address any concerns you may have by having a comprehensive financial plan done.

Now that you have a comprehensive financial plan in hand, the last major hurdle people face in their retirement is themselves. Rash emotional decisions that are made in the short term can derail your long-term retirement success and is akin to throwing that comprehensive financial plan that you had in the trash.

Emotional Decision Making

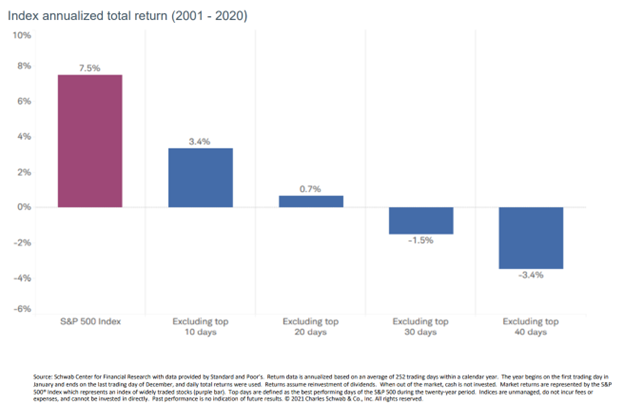

Many people believe that people in the finance and investment industries know everything about the stock market and can time the stock market. However, that is not true and any financial advisor that says otherwise is in our opinion lying. If you or I could time the stock market, you wouldn’t be reading this article and I wouldn’t be writing this article. You would be on your yacht, and I would be on mine. Where I add value as a financial planner is by making sure that you don’t make any rash, short-term emotional decisions that impact the long-term success of your plan. In this case, you can be your own worst enemy when it comes to your retirement plan. When you get nervous and make an emotional decision, the below chart illustrates what the consequence of doing so can be:

As you can see, thinking that anyone can time a stock market downturn can be detrimental. We don’t know when those top 10 days over a 20-year period will occur, but we know that if you’re invested every day during that 20-year period, you will (by default) hit those 10 best days. Getting out of the market (regardless of when or what the talking heads are saying) runs the risk of you missing out on those good days. Half of the S&P 500’s best days in the last 20 years were during a bear market. Where our firm adds value is keeping you level-headed and focused on your long-term financial plan.

In Summary

There are a number of other retirement enemies that we haven’t addressed and some of them might not apply to you. The only way to know which foes we need to help you face is by determining what your retirement picture looks like. This is done by crafting your comprehensive financial plan, having continued conversations about it throughout your lifetime, and updating it throughout life’s ups and downs. Get the process started by giving us a call or by emailing us at financialplanning@bfsg.com. We look forward to helping you get to and through retirement.

Additional Sources:

- GMO “Who Ate Joe’s Retirement”, 2015. (https://www.nebo-gmo.com/insights/whitepapers/who-ate-joes-retirement-3)

- Hartford “10 Things You Should Know About Bear Markets”, 2022. (https://www.hartfordfunds.com/practice-management/client-conversations/managing-volatility/bear-markets.html)

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s website or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please remember that different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy (including those undertaken or recommended by Company), will be profitable or equal any historical performance level(s). Please see important disclosure information here.