By: Steven L. Yamshon, Ph.D., Managing Principal

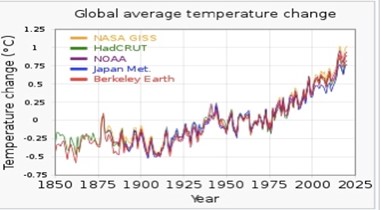

Regardless, if global warming is caused by natural forces or by excess greenhouse gases, there is clear evidence that shows that global temperatures have been rising since 1850 (See Chart 1). Although climate change will cause many adverse effects on Earth, the impacts on real estate and agriculture could be most severe.

Chart 1: Average global temperatures since 1850

For one, as the Earth temperature increases anywhere from 2 to 6 degrees Celsius, the melting of ice sheets in Antarctica and Greenland along with many, if not most glaciers, will lead to an increase ocean levels. In the period between 1900 and 2008, global sea levels have risen 6 to 8 inches with scientists predicting that sea levels will increase another 2 to 7 feet by 2150. Computer models are far from being exact and can only represent likely outcomes, so we don’t know exactly how much the ocean will rise. However, sea level increases of this magnitude could inundate global coastal cities such San Francisco, Miami (See Chart 2), or Shanghai. Locally, it would also affect south facing Southern California beach areas (See Chart 3). Unless massive mitigation plans are implemented, certain coastal properties may show a large decline in value. This is something investors should be aware of.

Chart 2: Miami land masses affected by a rise in sea level

Chart 3: Coastal flooding in Capistrano Beach, California due to projected climate change

A second implication of climate change is that hotter weather will affect agricultural production. Continued droughts could lead to dry reservoirs, impaired aquifers, and decimate other water sources which could result in a decline of agriculture and food production causing higher food prices and inflation. As temperatures increase some of the crops traditionally planted by highly mechanized and large efficient farmers may need to change. For example, corn which is used for food and ethanol can only be grown in a fairly narrow range of temperatures between 90- and 100-degrees Fahrenheit. Agricultural experiments have shown that certain crops like soybeans have reduced yields as temperatures increase. It may be very likely that farmers may have to change the type of agricultural products that they are growing or move their farms to more favorable climates. Farmland is already being impacted in California as ranchers and farmers destroy thousands of acres of almond groves because of the huge water requirements (See Chart 4). With California being in a multi-year drought and water supplies being reduced from the California Aqueduct and the federally run Central Valley Project, I suspect more almonds along with other high water requiring crops such as pistachios will have to be removed with former farmland being taken out of production.

Chart 4: Implications of Climate Change on Agriculture: Almond trees removed in the Central Valley of California due to drought

If climatologists and scientists are right about climate change and that coastal areas will be impacted as well as agriculture, we can expect higher food costs, rationing of water, inflation, and the abandonment of some land. However, there will be opportunities for us to invest in farm and forestry land that will be less affected by climate change and to invest in clean technologies and infrastructure that will help with mitigation and adaption.

References:

- Englander. J. (2013). High Tide on Main Street. Boca Raton, FL: The Science Bookshelf.

- Hertsgaard, M. (2011). Hot: Living Through the Next Fifty years on Earth. Boston, MA: Mariner Books.

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s web site or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please see important disclosure information here.