By: Thomas Steffanci, PhD, Senior Portfolio Manager

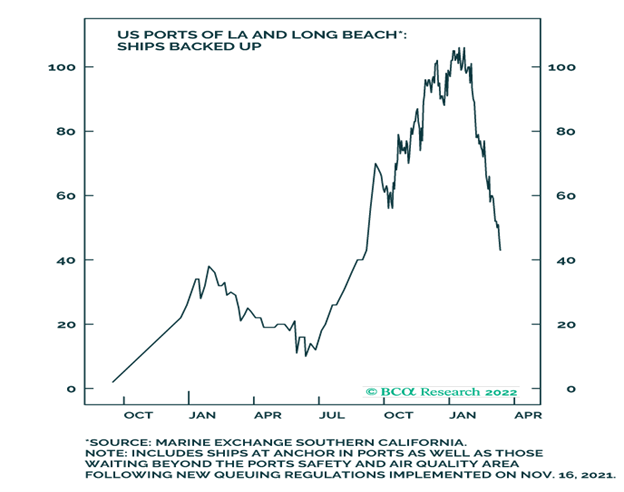

The first link in the supply chain, the number of ships backed up in Los Angeles and Long Beach harbors, is in sharp decline as the accompanying chart from BCA shows.

The harder part is relieving the structural scarcity of trucks, drivers, and logistics (i.e., port workers, warehouse capacity) to decompress supply-side inflation. As this is a longer-term problem, even with a slowdown in aggregate demand in the quarters ahead, overall inflation (aside from base effects) is likely to be stuck in the 3-5% zone for some time.

To a large extent, Covid sterilized labor force participation rates, as the willingness and ability to work may have been secularly altered. With birth rates declining and older workers reluctant to return to the labor pool, long term inflation is unlikely to return to the sub-2% pre-pandemic levels. These factors among others will ultimately induce the Federal Reserve (the “Fed”) to alter their inflation target or else risk a policy-induced recession.

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s website or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please remember that different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy (including those undertaken or recommended by Company), will be profitable or equal any historical performance level(s). Please see important disclosure information here.