We have spoken about the speculation in the markets (watch the Coffee with Dr. Steve – The Time Tunnel we posted in August) and others have pointed out how inexperience can lead to staggering losses (read the New York Times article published in July on this topic).

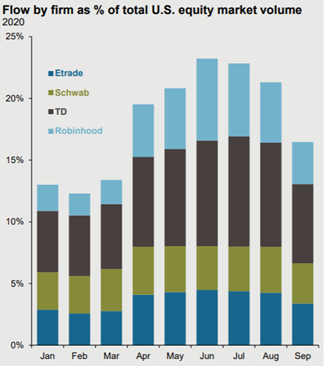

However, speculators continue to pile into the stock market with retail brokerage firms Robinhood, TD Ameritrade (now owned by Charles Schwab), and E-Trade (now owned by Morgan Stanley) acting as the kindling to ignite this speculative impulse.

Source: J.P. Morgan Asset Management, Guide to Alternatives. Based on company filings, SEC 606 disclosures. Data is based on availability as of November 30, 2020.

An illusion that money can easily be made is usually a recipe for disaster. Ben Graham, who many consider the “father of value investing” and who wrote the classic The Intelligent Investor, said, “The typical experience of the speculator is one of temporary profit and ultimate loss”. This new wave of investors will eventually learn some very old lessons.

Meanwhile, BFSG’s philosophy is geared to those intelligent investors who want us to purchase sound securities for them as part of a disciplined approach that aligns with their long-term goals.

1. The S&P 500 is designed to be a leading indicator of US equities and is commonly used as a proxy for the U.S. stock market.