By: Henry VanBuskirk, CFP®, Wealth Manager

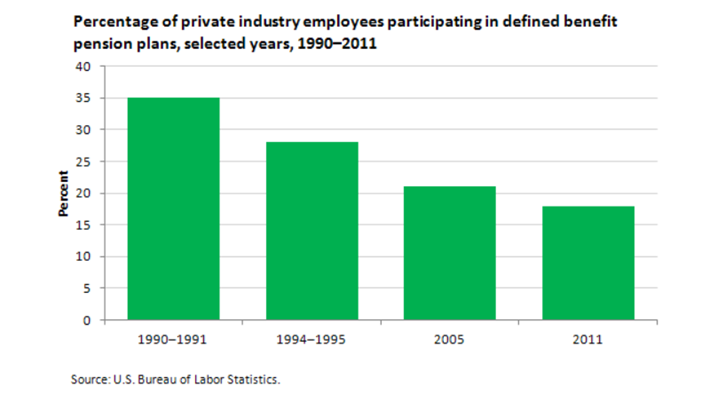

Most Americans know that the Defined Benefit Pension Plans are mostly a thing of yesteryear, usually something that only retired Teachers or Law Enforcement get now. The Bureau of Labor Statistics has been tracking this downward trend over time and it’s not a secret why pensions are starting to fade away from most Americans’ collective consciousness.

The above chart shows that only 18% of private industry workers were covered by some sort of defined benefit pension plan in 2011, dropping from 35% back in 1990. The numbers have only gone down since then, with 15% of private industry workers being covered by some sort of defined benefit pension plan.

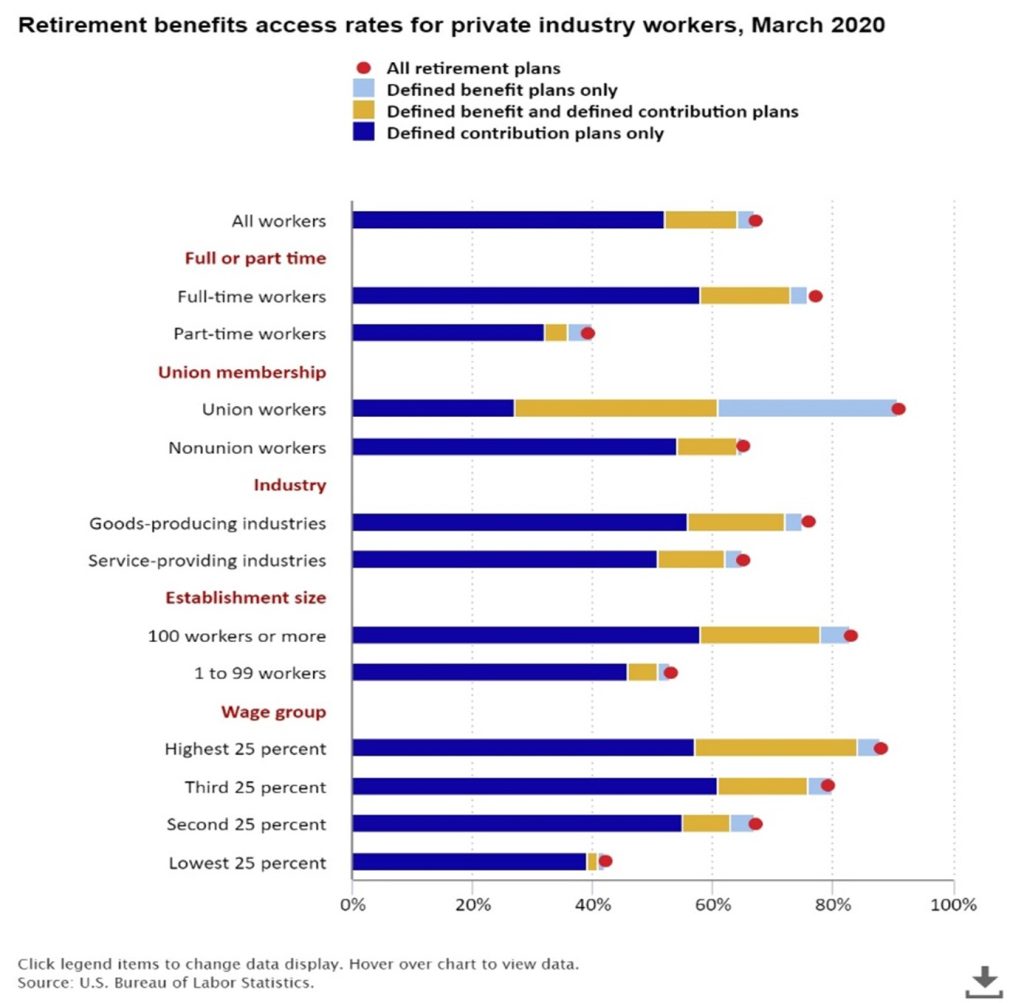

401(k)s and other Defined Contribution Plans have become commonplace and there’s no sign of that slowing down. The employer who offers a defined benefit pension plan incurs all of the risks of making sure that there are funds available to pay out an employee’s retirement benefit. Defined Contribution plans became popular because they allow employers to transfer that risk to the employee instead. If you are an employer, it makes sense from your point of view to offer a Defined Contribution plan like a 401(k) rather than a Defined Benefit plan like a pension plan.

With this backdrop, why am I spending all of this time and energy talking about the importance of a pension election? It’s because, for those lucky few whose employers offer a pension plan, it’s usually a significant part of their retirement assets and therefore worth writing about. Pension elections are irrevocable, and we want to make sure that you are making the right election for your situation. Most clients who will get a pension know that it’s an important decision and is usually the first thing they bring up when we work on their financial plan. The ramifications to your financial plan of a suboptimal pension election could be dire. Let’s walk through an example client to illustrate the impact of pension plan elections.

Case Study

Dewey Finn (age 60) makes $40,000 per year teaching Rock Appreciation and Theory at the School of Rock1 in Upstate New York. He is married to Tanya Hayden (age 65), who is the principal of Horace Green Elementary School in Upstate New York and earns $120,000 per year. They will both receive pensions when they retire.

Though Tanya enjoys her job, she feels that she’s ready to retire. Dewey up until recently has enjoyed his job at the School of Rock but has started to push back against the School of Rock’s insistence in recent years that their curriculum focus on more Contemporary Rock music. The main person spearheading this new curriculum for more Contemporary Rock music at the School of Rock is ‘The Man’, an imposing and uncompromising figure who is also the school’s principal. ‘The Man’ has told Dewey that he needs to adapt to the new curriculum soon or will be fired. ‘The Man’ calls Dewey into his office and they have the following discussion:

‘The Man’: “Dewey. You are a great teacher, but you need to conform to the new curriculum.”

Dewey: “I can’t. No Beatles. No Zeppelin. No AC/DC. No Motorhead. These kids won’t learn anything. They won’t be able to appreciate Contemporary Rock music if they don’t have a deep understanding and appreciation for the progenitors of Rock and Roll.”

‘The Man’: “You don’t appreciate Contemporary Rock music.”

Dewey: “You are correct, sir.”

‘The Man’: “Dewey, you’re fired.”

Dewey: “Fine! Um, do I still get the pension?”

‘The Man’: “Yes. You are fully vested in the plan.”

Dewey: “Then I’m out of here. Get lost!” [Dewey leaves]

‘The Man’: [To himself] “At least now we’ll get someone who understands that ‘the music’ hasn’t been about ‘the music’ in a long time. Oh, here comes Dewey’s replacement now.”

Mr. Sellout: [Enters ‘The Man’s’ office] “Thank you for the time, sir. I’m excited about this opportunity! Mr. ‘The Man’, I have so many great ideas to monetize this new curriculum for the Rock Appreciation and Theory class.”

‘The Man’: [To himself] “I think I like this guy, Mr. Sellout. He’s going places…”

‘The Man’: “Your resume is impressive, Mr. Sellout. I don’t need to hear anymore, you’re hired. You start on Monday.”

Dewey then somberly tells Tanya what happened. Tanya reminds Dewey that he shouldn’t let ‘The Man’ get him down and mentions that this may be a good opportunity to meet with our Certified Financial Planner™ professionals at Benefit Financial Services Group (BFSG) to do a comprehensive pension analysis for both of us. Dewey agrees and they schedule their meeting with BFSG.

Tanya is well prepared for the meeting with meticulous notes taken from multiple meetings with her HR Manager and supporting documents on her pension. Tanya’s pension election options available to her now are:

- Lump Sum benefit of $700,000

- Single life benefit for $45,500 per year (or $3,791.67 per month), with a cost-of-living adjustment of 3% per year.

- Joint life with 100% survivor benefit of $38,500 per year (or $3,208.33 per month), with a cost-of-living adjustment of 3% per year.

Dewey on the other hand did not have much verifiable information on his pension election options besides a coffee-stained piece of paper with hand-written notes on what his election options are. Dewey’s pension benefit election options available to him now are:

- Lump Sum benefit of $150,000 (though this number is unclear, given the black coffee stain on this number).

- Single life benefit for $8,000 per year (or $666.67 per month), with a cost-of-living adjustment of 3% per year.

- Joint life benefit with 100% survivor benefit of $5,000 per year (or $416.67 per month), with a cost-of-living adjustment of 3% per year.

Nevertheless, the CFP® professional working on their financial plan has to work with the data given. They pressed Dewey on the validity of the lump sum benefit number and asked that Dewey confirm this information with his HR department at the School of Rock. Tanya hands the CFP® professional the rest of the documents in a well-curated binder. Besides their pensions, their other assets, and their return assumptions for them are listed below:

- Cash of $50,000, earning 2% per year

- Dewey’s IRA of $100,000, earning 5% per year

- Tanya’s IRA of $600,000, earning 5% per year

- Primary Residence of $500,000, with its value increasing by 3% per year.

They have the following assumptions:

- They want to spend $60,000 per year in retirement and have no heirs.

- They have no debts and will not receive Social Security.

- While Dewey is in good health and has good longevity, Tanya is not in good health and believes that she’ll be lucky to make it to age 85. The financial planner recommends that they run the plan until both Tanya’s age 95 and Dewey’s age 95, but also wants to account for the events of premature death for either Dewey or Tanya.

- The financial planner also assumes an inflation rate of 3% for the life of the financial plan.

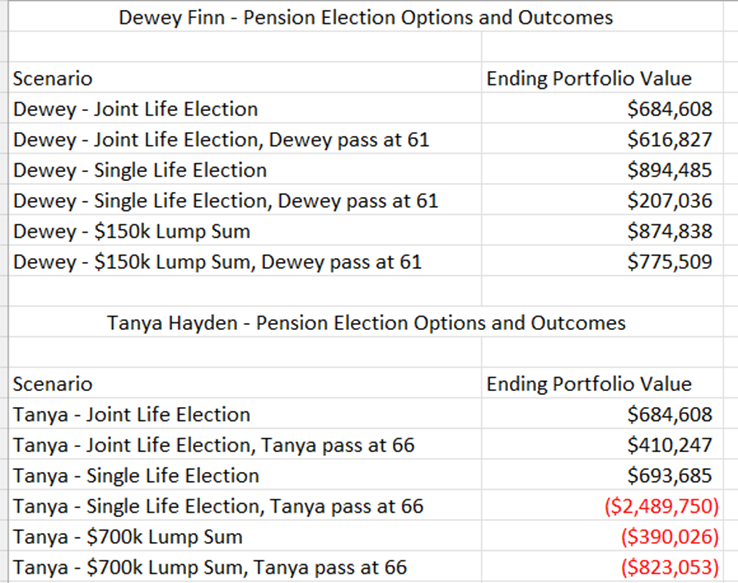

Based on this data, the CFP® professional determines the possible range of outcomes and presents Dewey and Tanya the following2:

*The Ending Portfolio Value means the amount of liquid cash and investments available to fund their living expenses. It does not include their real estate.

Starting with Tanya, this tells us that the only viable option that she has is to elect the joint life with 100% survivor benefit. This is the only option that has a positive ending portfolio value regardless of when Tanya passes away. Tanya was originally thinking that this option would be the most appropriate for her since she is not in good health and appreciates receiving this confirmation from her CFP® professional.

Dewey has a few different options available to him since none of them end in a negative ending portfolio value. Dewey is younger than Tanya and is in better health, it can be assumed that Dewey will outlive Tanya. While the single-life option allows for the greatest ending portfolio value of $894,485, the lump-sum election offers the least variability in ending portfolio value between $775,509 – $874,838 depending on if Dewey passes away between ages 61-95. Dewey understands that the lump sum benefit would mean rolling over the lump sum tax-free into an IRA rollover account, where he would be subject to Required Minimum Distributions (RMDs) later in retirement. Electing the lump sum would mean forgoing the guarantee of an $8,000 single life pension payout for the opportunity to invest the lump sum in an IRA rollover account in the stock market to possibly earn more than the $8,000 per year benefit could offer. Further, distributions from the IRA rollover account are only guaranteed as long as there is money in the IRA rollover account to take distributions from.

Dewey is excited about the lump sum election and asks the CFP® professional how to open an IRA rollover. Dewey, Tanya, and the CFP® professional have the following discussion:

Dewey: “I would like to open an IRA rollover, but filling out paperwork usually leaves me Dazed and Confused3. I want to make sure it’s filled out right. Could you help me with the paperwork?”

CFP® Professional: “No problem. We’ll work with your HR department to gather the paperwork and afterwards our office can fill out the IRA rollover paperwork for you to review and sign. Since the pension election is an irrevocable decision, we want to confirm the numbers with the HR department before you sign. We also want to confirm the numbers with Tanya’s HR department before she signs as well.”

Tanya: “Sounds good to me.”

Dewey: “This is great! I’m ready to invest the proceeds from the lump sum in the new IRA rollover account.

Tanya: “Thank you for your time. We’ll schedule a call next week with you and our HR departments to confirm the information.”

Dewey: “Thank you.”

CFP® Professional: “You’re both welcome.”

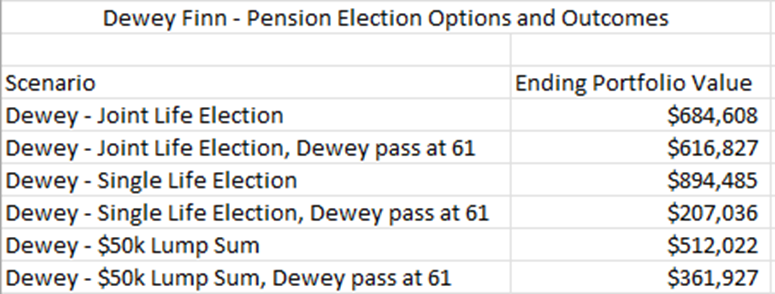

They have the calls with the HR department and confirmed that everything that Tanya presented the CFP® Professional was correct. Dewey’s HR department confirmed that the numbers for the single-life benefit and the joint-life benefit election options as correct, but the lump sum benefit was actually $50,000, not $150,000. Tanya was upset with Dewey since he was confident in all of the numbers he provided, but now they’ll need to redo the pension options. Dewey turned to Tanya and said, “Hey, I got two out of the three pension election option numbers correct. Last time I checked, Two Out of Three Ain’t Bad4.” Dewey and Tanya then meet with their CFP® professional again, where they have the following adjustment for Dewey’s options:

Reviewing the numbers again, the lump sum pension option no longer makes sense. This is because the range of outcomes is now $361,927 for Dewey passing at age 61 to $512,022 for Dewey passing at age 95. Since the single-life benefit offers the highest ending portfolio value of $894,485 and Dewey is much more likely to outlive Tanya, it is recommended that he elect the single-life benefit option. Tanya breathes a sigh of relief since now Dewey won’t have control over the proceeds of a lump sum distribution and the $8,000 per year is guaranteed for the rest of Dewey’s life. The last time Dewey made the investment decisions for himself, he invested all of his IRA in Bitcoin two years ago and managed to decrease his IRA’s value from $200,000 two years ago to $100,000 where it is today5. Tanya now makes the decisions on Dewey’s IRA and it is invested in a diversified mix of mutual funds and ETFs of stocks and bonds.

Tanya and Dewey are glad that they confirmed what benefit election options to pick and filled out the paperwork to elect the Joint Life benefit for Tanya’s pension and the Single Life benefit for Dewey’s pension.

Conclusion

In reality, most pensions have many more options available to you than just a lump sum, single life, and joint and 100% survivor benefit. Some other options that could be available to you are: 10-year period certain, 10 years only, joint life with 50% survivor benefit, or a combination of some lump sum payment with a guaranteed payment option. Since persons who have access to a pension may not have access to a defined contribution like a 401(k) or the income from the pension would make up a large portion of their cash flow in retirement, it is important that we get that irrevocable choice of a pension election correct before that paperwork is signed. Our team of CFP® professionals is on standby to provide you with a comprehensive pension analysis with your detailed financial plan. Give us a call at 714-282-1566 or email us at financialplanning@bfsg.com to get started.

Footnotes:

- Very loosely based on Jack Black’s character, Dewey Finn, from the movie School of Rock (2003). Tanya Hayden is Jack Black’s actual wife.

- Detailed illustrations of any analysis ran are available upon request.

- Released by Led Zeppelin in 1968, “Dazed and Confused”.

- From the 1978 single from Meat Loaf, “Two out of Three Ain’t Bad”.

- Whether you are investing on your own or having a firm like ours do it for you, we recommend a globally diversified investment portfolio tailored to your ability and willingness to take and accept risk. We normally also do not recommend having more than 10% of your investable net worth in one position. Bitcoin over the last 2 years: https://finance.yahoo.com/quote/BTC-USD?p=BTC-USD&.tsrc=fin-srch

Sources:

- https://www.bls.gov/opub/ted/2021/67-percent-of-private-industry-workers-had-access-to-retirement-plans-in-2020.htm

- https://www.investopedia.com/ask/answers/100314/why-were-401k-plans-created.asp

- https://www.bls.gov/opub/ted/2013/ted_20130103.htm

- https://www.thestreet.com/personalities/jim-cramer-sees-key-investing-advice-in-svb-fallout

- https://finance.yahoo.com/quote/BTC-USD?p=BTC-USD&.tsrc=fin-srch

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s website or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please remember that different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy (including those undertaken or recommended by Company), will be profitable or equal any historical performance level(s). Please see important disclosure information here.