By: Thomas Steffanci, PhD, Senior Portfolio Manager

Has the Federal Reserve (the “Fed”) caused the burst in inflation over the past year? Not Likely.

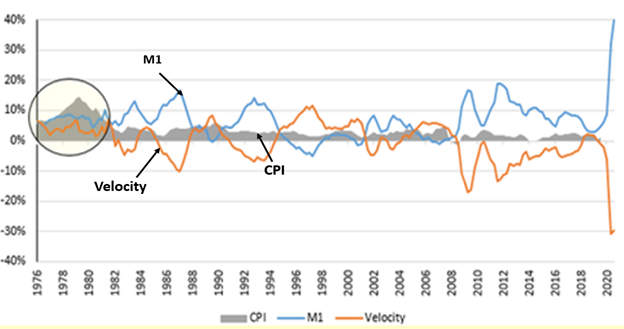

While the Fed can influence money supply (M1) growth, they can’t control how fast it is spent. Money velocity measures how many times a dollar of money supply circulates. If M1 growth rises but it is saved (a decrease in velocity), GDP and prices will stagnate. In the 1970’s (circle) both M1 and velocity rose, causing rapid inflation. Contrast that to today, where the Fed caused an historic expansion in M1 to counter the pandemic/recession. But until recently, inflation was quiet as households and businesses hoarded cash and velocity plummeted. The supply chain wreck caused by the pandemic have been the major factors in elevating inflation, not “excessive” M1 growth.

But this speaks of the Fed’s policy impact on inflation. If/when velocity rises as Covid subsides and lockdowns end, economic activity is likely to rise, lifting velocity, and that may frustrate the Fed’s attempts to control inflation. It would largely be out of their hands at that point.

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s website or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please remember that different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy (including those undertaken or recommended by Company), will be profitable or equal any historical performance level(s). Please see important disclosure information here.