By: Thomas Steffanci, PhD, Senior Portfolio Manager

The July minutes of the Federal Reserve’s (the “Fed”) latest policy meeting were released on August 18th to the hue and cry of Wall Street pundits about the Fed making plans to pull back the pace of their monthly bond purchases before the end of the year.

The ongoing assumption has been that the Fed’s tapering would begin next year and be spread throughout 2022. The stock market reaction was swift and sharp as the Dow Jones Industrial Average fell nearly 2% in two days as expectations swirled that the first rise in the Federal Funds rate may be similarly pushed forward to next year, rather than in the prevailing opinion to 2023.

Now so far, the Fed has not disclosed any timetable of either of those two events. Several members of the Federal Open Market Committee (FOMC) have made public comments about a timetable which on balance has called for an early start to tapering and a year-end 2022 first increase in the Federal Funds rate. These members have touted the strength of the economy as rationale for their views.

Why is all this important? Because current, real time, economic data are indicating a sharp slowing of the economy, especially in retail and home sales, along with continued declines in consumer buying intentions and homebuyer expectations. And survey data show consumers now expect a more negative economic impact from Covid than they have for the past several months. Covid-sensitive spending in restaurants, air travel and hotels has weakened further in August. Higher frequency indicators of consumer activity such as daily credit card spending have flat-lined since mid-July.

There is an historical irony in all of this. In past cycles, the Fed was behind the curve in reacting to rising inflation accompanying above trend economic growth, raising interest rates sharply and too late, precipitating a credit crunch and a recession, or a tightening policy in anticipation of rising inflation which did not occur (2017-2018). What may be unfolding here is much the same thing.

If market signals are correct on the growth slowdown, which the Fed’s econometric models fail to pick up, they would wind up behind the curve by beginning to reduce their bond purchases too early, raising false expectations that current conditions cited above are mere transitory data points. They are likely not…the economy is tapering toward an identifiable growth slowdown in the months ahead, putting the Fed’s 7% estimate for 2021 GDP growth in serious jeopardy. The lesson is that the Fed will need to be more cautious in their plans for the speed and timing of their tapering plans.

What would be the market impact? As market signals become reflected in hard data, expectations of a Fed policy reset could elevate equity prices, raise commodity prices, and keep bond yields low. As 2022 is an off-year election, inflation would not be a policy problem in an economy that downshifts to trend growth, and any political resistance turns to congressional job preservation.

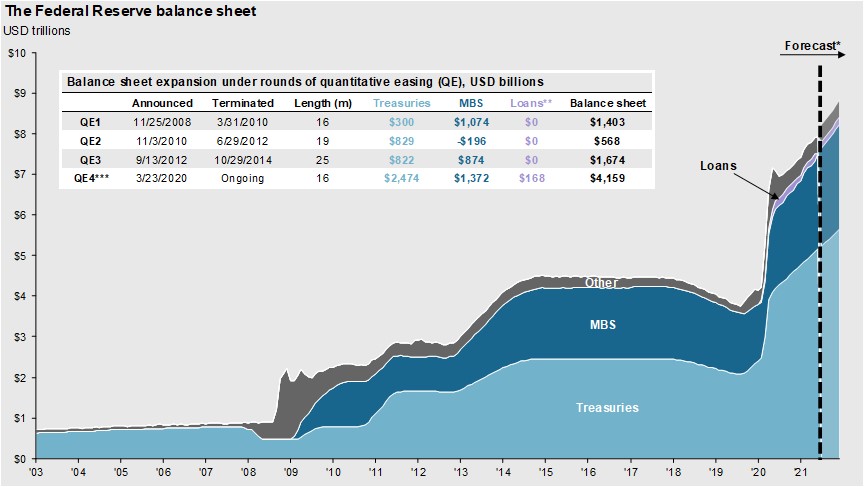

Chart Source: FactSet, Federal Reserve, J.P. Morgan Investment Bank, J.P. Morgan Asset Management. As of August 20, 2021.

*The end balance sheet forecast assumes the Federal Reserve maintains its current pace of purchases of Treasuries and MBS through December 2021 as suggested in the June 2021 FOMC meeting. **Loans include liquidity and credit extended through corporate credit facilities established in March 2020. Other includes primary, secondary and seasonal loans, repurchase agreements, foreign currency reserves and maiden lane securities. ***QE4 is ongoing and the expansion figures are as of the most recent Wednesday close as reported by the Federal Reserve.

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s web site or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please see important disclosure information here.