By: Paul Horn, CFP®, CPWA®, Senior Financial Planner

In the first part of this series, we reviewed deferred compensation plans. This week we are looking at stock options.

Stock Options

There are 3 basic forms of stock options that we will review today. We will look at them from most to least common:

Restricted Stock Units (RSUs)

Restricted Stock Units (RSUs) are the most common form of stock options available these days. Companies like them because they are not required to have the underlying stock on the balance sheet of the company. RSUs are offered on a vesting schedule over a period of time. For example, let’s assume a company offers 1,000 shares of Restricted Stock that vest 250 shares per year over four years. Vesting refers to a period of time an employee is required to wait before they can have access to the shares.

| Grant Date | Number of Shares | Vest Date |

| 3/1/2022 | 250 | 3/1/2023 |

| 3/1/2022 | 250 | 3/1/2024 |

| 3/1/2022 | 250 | 3/1/2025 |

| 3/1/2022 | 250 | 3/1/2026 |

| Total shares | 1,000 | |

As the shares vest each year the value of the shares is taxed as ordinary income. Let’s assume the stock price is $100 a share on 3/1/23. The employee is then subject to $25,000 (250 shares * $100 per share) in additional taxable income for 2023. After the stock vests, the employee can choose to take cash less the amount held for taxes after they sell the stock, or they can keep the shares and let them potentially grow over time. In general, it is best to treat RSUs as a cash bonus and sell all the shares since this is how the IRS treats them from a tax perspective. The money can be reinvested in other investments to allow for better diversification.

Tips for RSUs

- Treat RSUs like a cash bonus and exercise (sell) them in the same year they vest. You can then reinvest the cash into other investments.

- If you hold the stock after it vests, wait at least one year to take advantage of long-term capital gains tax rates.

- Try to negotiate for non-qualified stock options or incentive stock options for a more favorable tax treatment of your stock options.

- You will lose any unvested RSUs when you leave the company.

Non-Qualified Stock Options (NSOs)

Non-qualified stock options (NSOs) work similarly to RSUs where you receive a specified amount of stock options that vest over time. A key difference is how the NSOs are taxed. The NSOs have a stock price called the exercise price that is determined at the time the grant is received. Unlike RSUs that trigger taxes at the time they vest, NSOs allow the employee to determine when the taxes are triggered. This is done when they exercise the stock options and the difference between the exercise price and the actual stock price is the amount subject to income taxes.

Assume that 200 shares have vested in ABC stock. The exercise price on the stock is $25 and the current market price is $40. Below is how we calculate the amount subject to taxes:

Total Market Price ($40 * 200) – Total Exercise Price ($25 *200) = Bargain Element (Amount subject to taxes)

$8,000 – $5,000 = $3,000 subject to income taxes

Non-qualified stock options are more favorable for the employee than RSUs. The employee has a specified period (typically ten years from the date of grant) that they can choose to exercise the stock options. At the time of exercise, you can choose to take the cash minus taxes or hold the shares. With NSOs (and ISOs, which we cover next) you can choose an 83(b) election that triggers taxes in the short term but can lower taxes over the long term. An 83(b) election has to be made at the time you receive the stock options (at the date of grant) and essentially requests the IRS to recognize income on the stock options now. By paying income taxes on the grant at the time you receive them you switch the growth on the stock options from income tax rate to the lower long term capital gains tax rates. It is best to work with a Certified Financial Planner™ or tax professional to see if this makes sense given your situation.

Tips for NSOs

- Work with a Certified Financial Planner™ professional or tax professional for tax planning (for example exercising more stock options in a year you have a lower income).

- Any NSOs not exercised at the time you leave the company will be lost forever.

- You can wait till the deadline (which can be as long as 10 years) to exercise. This allows you more flexibility from a tax perspective.

- When you exercise the stock option you have the choice of taking the stock or cash. If you choose to hold the stock it is best to wait at least one year to sell the stock to take advantage of long-term capital gains.

- Talk with a tax professional or Certified Financial Planner™ professional to see if an 83(b) election is right for you.

Incentive Stock Options (ISOs)

The unicorn of stock options is Incentivized Stock Options (ISOs). These are the most favorable for an employee from a tax perspective. There are many rules around ISOs and because of their complexity, they are the least common type of stock option. Themost common place I see these are for key employees that work for start-ups in the tech space. Since it is difficult for them to compete for talent with the bigger names in the tech space they have relied on ISOs as a key differentiator to attract top talent. For the most part, ISOs work very similarly to NSOs where you pay taxes on the bargain element. The key difference though is that with ISOs you pay no taxes at the time of exercise and get more favorable tax treatment at long-term capital gains rates if you meet certain holding requirements (see below).

Total Market Price ($40 * 200) – Total Exercise Price ($25 *200) = Bargain Element (Amount subject to taxes)

$8,000 – $5,000 = $3,000 subject to long-term capital gains taxes

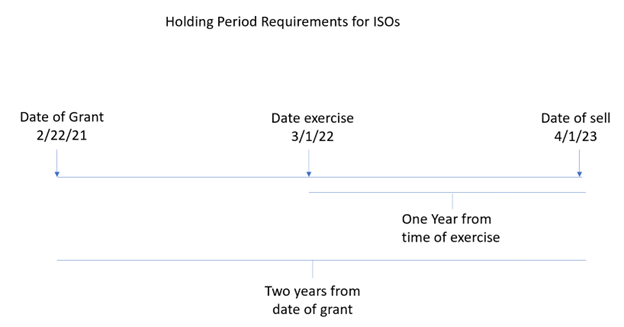

To get preferential tax treatment there are some requirements you must meet:

- You must hold the stock for at least two years from the date of the grant

- You must hold the stock for at least one year from the time of exercise.

It is imperative that you work with a Certified Financial Planner™ professional when working with ISOs. Aside from the complex holding period requirements, there are additional requirements as well. The date that you exercise (not sell!) the options you trigger potential Alternative Minimum Tax (AMT) issues. The IRS also limits an individual to $100,000 in ISOs in a given year. Any amount over $100,000 loses ISO treatment and is taxed like an NSO. Careful planning is required for ISO treatment and you must keep this in mind if you are considering switching employers.

Tips for ISOs

- You must hold ISOs for at least 2 years from the date of grant and at least 1 year from the date of exercise to get preferred tax treatment.

- Work with a Certified Financial Planner™ professional and tax professional to put together a plan limiting AMT tax issues.

- It may be beneficial to intentionally trigger the NSO tax treatment for a portion of the ISOs (for example, leaving your current employer for a better position). A Certified Financial Planner™ professional or tax professional can help you understand and do this strategy if necessary.

- In a down stock year, it is beneficial to work with a professional and maximize how many options to exercise.

- Work with a Certified Financial Planner™ professional to see if an 83(b) election makes sense, since it can lower your AMT tax burden.

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s website or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please remember that different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy (including those undertaken or recommended by Company), will be profitable or equal any historical performance level(s). Please see important disclosure information here.