“If you like laws and sausages, you should never watch either one being made.” – Otto von Bismarck

Over four long days and through 66 amendments, the House of Ways and Means Committee, the chief tax-writing committee of the United States House of Representatives, wrapped up the mark-up of the Build Back Better Act. The recommendations for spending and/or revenue changes have been submitted to the Budget Committee, where the separate measures are packaged and eventually reported to the floor for debate by the House. Modifications to the tax bill could come when it is sent to the House Rules Committee or through an amendment on the House floor. The reconciliation process will then follow in the Senate including complying with strict budget reconciliation requirements in the Senate known as the “Byrd rule,” attaining the support of all 50 Democratic senators, as well as the looming Sept. 30 expiration of federal surface transportation programs. Challenges for the tax legislation remain in the Senate.

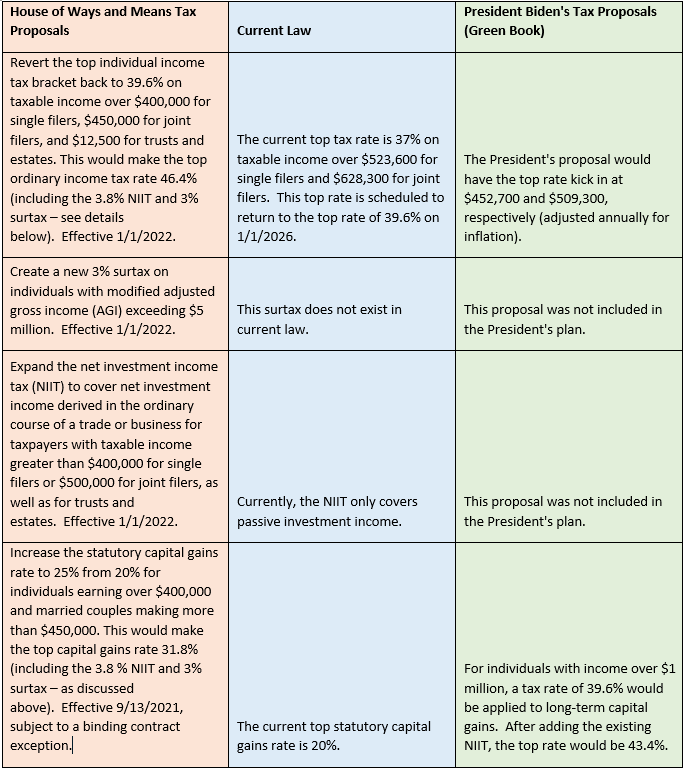

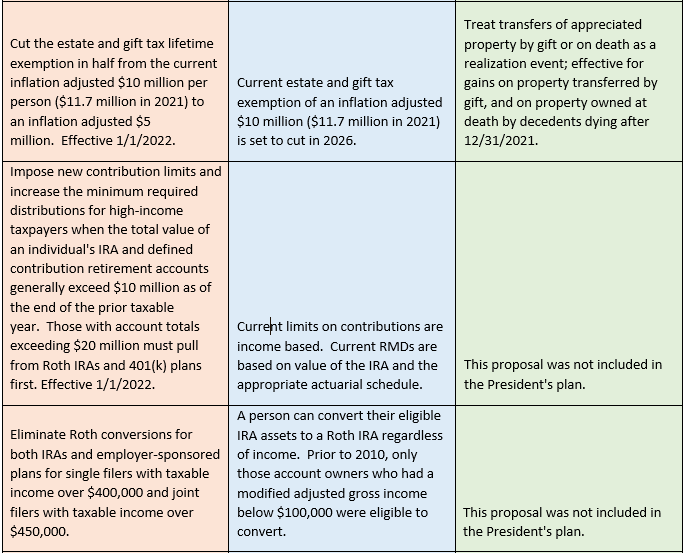

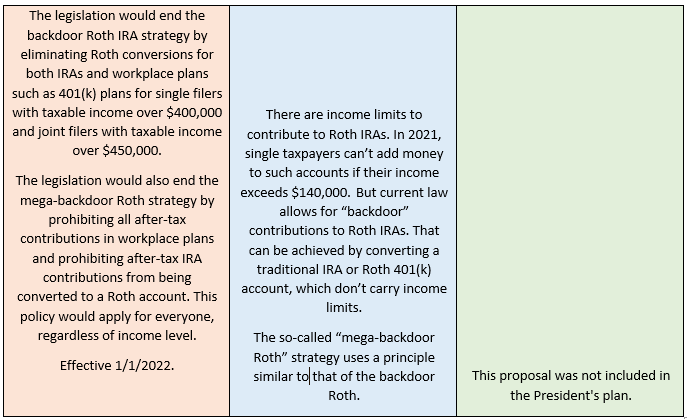

We have included a summary of several of the House of Ways and Means Committee proposals (including the effective dates) that may affect you:

White House officials have been vocal about a desire to design a tax increase that prevents taxpayers from taking advantage of any gap before the increase begins, hence the September effective date for some of the tax proposals. If at any point the Biden administration and/or Democrats need to find revenue to secure their legislative plans, they may negotiate for the April Green Book effective date. As negotiations in Washington stand presently, however, we assess the likelihood of an April 2021 effective date as somewhere in the vicinity of less than likely.

Given how the legislative meat grinder turns out many strange products, we are anxious to see the final Build Back Better Act before acting on any of the proposals. However, we are starting to prep for year-end meetings to discuss estate planning strategies, income tax strategies, tax planning strategies, and charitable gifting strategies. We look forward to working with you, our valued clients, and in close consultation with your tax professional before year-end.

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s web site or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please see important disclosure information here.