The title might take many of you by surprise and this topic is not to discourage homeownership but is more geared to explaining why your home (and possibly other properties) may not be the best investment or why your home should not be viewed as an investment.

The primary focus of this article will be on your primary residence and not on rental properties. We are also going to assume that this is just an average community without any additional factors such as a gold rush, or a green rush, or an establishment as the next Silicon Valley. In those circumstances, real estate can outpace the national average. Do not forget the three things that matter in real estate is location, location, location!

The ability to use leverage (borrow money from the bank) is what attracts people to invest in real estate. When you buy the home you only have to put down 20% or less in some cases and the bank gives you a loan to pay on over the next 30 years (or whatever term you select). For example, purchasing a home for $500,000 in a traditional scenario requires 20% down ($100,000) and the bank provides a loan over 30 years for $400,000. With rates near historic lows (2.75%) the payment for this 30-year loan is about $2,041 per month.

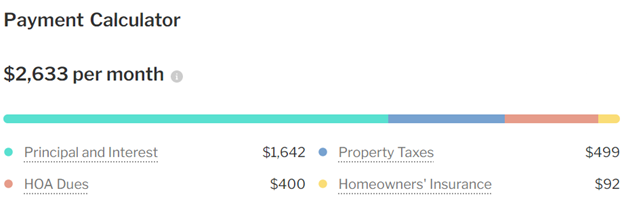

The downside to using leverage is that it has a cost. Looking at the loan above ($400,000 loan at 2.75% interest for 30 years) you would pay over $187,000 in interest over the life of the loan! To put this another way, instead of buying the home at $500,000 you are paying $687,000 for the home ($500k purchase price + $187k interest paid). Owning a home is expensive and has many additional costs besides the loan. With a home, you have to pay property taxes, homeowner insurance, repairs, and potentially other costs like homeowner’s association (HOA) or mortgage insurance if your down payment is less than 20%. Below are the estimated costs for a $500,000 home in Orange County:

What we see is that the true cost of homeownership is much higher than we realize. The example above does not take into account any upgrades or repairs and maintenance the home may need as well. With the costs for owning a home so high, this lowers the actual investment return of the home.

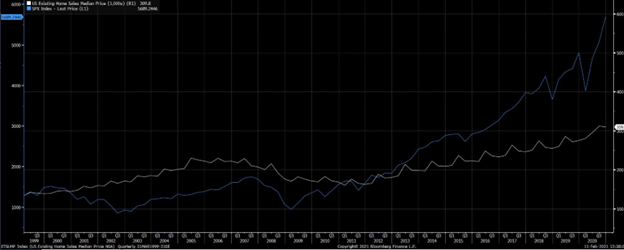

We all know that home prices go up over time, but many people are not aware that the primary driver for the increase in home prices has been inflation. If you look at the chart below, it shows since March 1999 until now real estate home prices (1) have grown 131.37% and stocks (2) have grown 342.27%.

Another factor that needs to be considered when looking into real estate as an investment is liquidity. Other investments like the equity and bond markets provide liquidity and you can have access to your money quickly. For real estate, this is not necessarily the case and it can be difficult to get your money back. If major employers move out of the area, you cannot quickly sell your home before home prices drastically shift downward.

Please understand we are not telling you to not buy a home. Homeownership is one of the biggest accomplishments one can achieve and provides security and stability for you and your family. We just caution against considering your primary residence to be considered an investment like many people recommend. Real estate is good as part of an overall portfolio but can be done in many ways in a more liquid manner. Please feel free to contact us to discuss how this article impacts your circumstances.

- U.S. Existing-Home Sales, National Association of Realtors (www.nar.realtor.com)

- The S&P 500 is designed to be a leading indicator of U.S. equities and is commonly used as a proxy for the U.S. stock market. Price return quoted.

Disclosure:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Benefit Financial Services Group (“BFSG”), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from BFSG. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. BFSG is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of BFSG’s current written disclosure Brochure discussing our advisory services and fees is available upon request

BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s web site or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please see important disclosure information here.