Focus on What You Can Control

By: Paul Horn, CFP®, CPWA®, Senior Financial Planner

The goal of every investor is to get the best returns possible per unit of risk based on your risk tolerance (the “optimal portfolio”). No matter how much research you do or the investment philosophy you use, at the end of the day there are many variables that you cannot predict or control for when you are making investment decisions. So much time is spent by the financial gurus discussing how to try and create alpha (i.e., excess returns above the market benchmark return), but it is very difficult to do so consistently. What is often overlooked in these conversations, is focusing on the variables that you can control, like costs and taxes.

What you keep as an investor is returns after fees and taxes. Fees are relatively easy to control as you can compare similar investments and see what the net expense ratio is for the Exchange Traded Fund (ETF) or mutual fund. For example, if two S&P 500 index funds have similar characteristics, low tracking errors, and return profiles, it would typically be best to choose the fund with lower fees. You can use tools like Morningstar.com to easily compare fees.

The harder factor to control and the least understood is taxes. Let’s start with the basics of understanding long-term capital gains (LTCG) vs. short-term capital gains (STCG).

Any investment that is held for less than 12 months (this is always the case with options) will pay taxes at ordinary income tax rates.

Short term gains (positions held 12 months or less) taxed as ordinary income tax rates

- The max federal tax rate is 37% plus a 3.8% Net Investment Income Tax (NIIT)*

* If your Adjusted Gross Income (AGI) > $200,000 Single; or AGI > $250,000 Married Filing Jointly

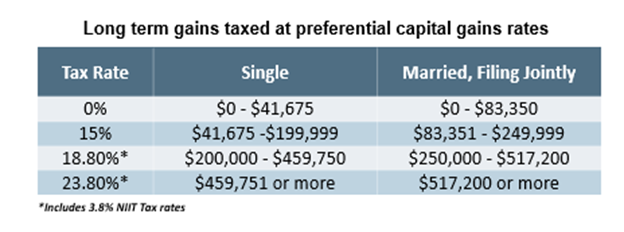

When you purchase the investment and if you hold it for more than 12 months, then it is considered a long-term capital gain and the investment receives preferential tax treatment.

Below is a chart summarizing long term gain tax rates for 2022.

You will notice in both scenarios (short-term or long-term gains), there is an additional tax you may pay called Net Investment Income Tax (NIIT) if your income is greater than $200,000 single or $250,000 married filing jointly (MFJ). There is no way to get around this surtax, but it is important to understand.

Let’s take a closer look at the drastic impact taxes can have. Let assume a married couple makes $400,000 per year and bought ten shares of XYZ stock for $100 per share on January 1, 2021. Now assume the shares are sold on December 1st of 2021 at $180 per share. This results in a gain of $80 per share, that would be taxed at short-term capital gains at a tax rate of 35.8% based on this hypothetical couple’s income (32% MFJ ordinary income tax rate + 3.8% NIIT).

However, if the shares are held a month and a day longer and sold on January 2nd, the shares would have been taxed as long-term capital gains. This is a more favorable tax rate of 18.80% for the couple (NIIT applied in this example).

Below is a summary to help clarify:

| Tax Rate Short Term Capital Gain (w/ NIIT) | 35.8% |

| Tax Rate Long Term Capital Gain (w/ NIIT) | 18.8% |

| Taxes per share paid at STCG | $ 28.64 |

| Taxes paid at LTCG | $ 15.04 |

You can see here with proper planning you can easily make an additional $13.60 per share by getting a long-term capital gains tax rate. This is just a simple example of how tax planning can increase the return on your investments.

With tax planning, another strategy to use is called tax location. The idea here is to keep your investments in the proper account to limit tax drag. For example, interest from bonds is normally taxed as ordinary income. It may seem counterintuitive, but it is best to keep bonds in a tax-deferred account. This will save you on your annual taxes, since in the tax-deferred account you only pay taxes at the time of withdrawal. Remember withdrawals from tax-deferred accounts are always taxed as ordinary income just like how the bond interest is taxed. Stocks on the other hand, should usually be held in either Roth retirement accounts or a taxable brokerage account. This will allow the best growth potential* to occur in the Roth account, which is favorable because the Roth account grows tax-free, and distributions are also tax-free (*stocks typically have higher reward potential based on their risk compared to bonds). The taxable brokerage account allows you to take advantage of preferential tax rates (long-term capital gains) since stock gains are treated as capital gains (as long as held the position for longer than a year). That is why in accounts for BFSG clients we strive to use this tax location method to try and reduce tax drag in portfolios.

These strategies do not guarantee returns, but certainly give you the best chance of future outperformance. To be successful with investments, as with anything in life, focus on what you can control. By using a disciplined approach, these strategies should help your investments grow at a higher rate of return to help you achieve financial independence sooner. If you would like to discuss this in further detail or how this applies to your situation, please contact us at financialplanning@bfsg.com

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s website or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please remember that different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy (including those undertaken or recommended by Company), will be profitable or equal any historical performance level(s). Please see important disclosure information here.