Stocks rebounded in March even as the Russia/Ukraine conflict continued to escalate. The key message from the Federal Reserve is that it is focused on fighting inflation and is prepared to hike short-term interest rates steadily and reduce its balance sheet until it reaches its goals. Q1 earnings season will kick off the week of April 11th and although Wall Street analysts have recently scaled back their expectations for quarterly earnings, they’ve been raising their forecasts for the rest of the year, according to FactSet. Earnings typically are the key engine of equity returns over the long run.

Here are 3 things you need to know:

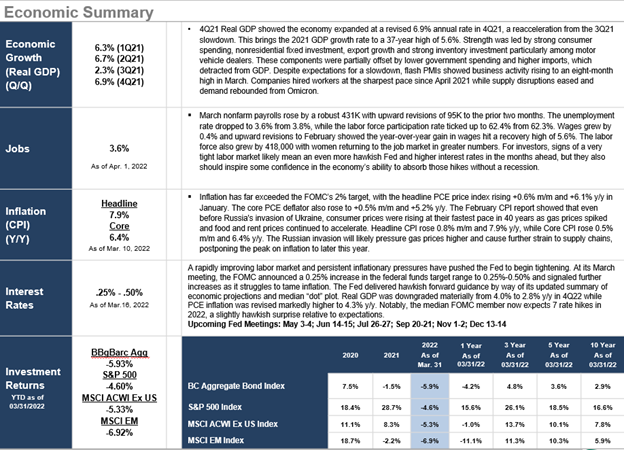

- U.S. inflation data showed price increases hovering near 40-year highs. The report showed a further rotation back to services spending as the economy, and away from goods spending.

- Jobs data showed a robust labor market with the unemployment rate dropping to 3.6% from 3.8%, while the labor force participation rate ticked up to 62.4%.

- The 1st quarter was one of the worst quarters for 10-year Treasury bonds since the early 1980’s. The Treasury yield curve inverted (higher yields for shorter-term bonds vs. longer-term bonds) between the 10-year and 2-year notes and 30-year and 5-year bonds, further stoking concerns of an impending recession.

Sources:

- Sources: J.P. Morgan Asset Management – Economic Update; Bureau of Economic Analysis (www.bea.gov); Bureau of Labor Statistics (www.bls.gov); Federal Open Market Committee (www.federalreserve.gov)

- Indices:

- The Barclays Aggregate Bond Index is a broad-based index used as a proxy for the U.S. bond market. Total return quoted.

- The S&P 500 is designed to be a leading indicator of U.S. equities and is commonly used as a proxy for the U.S. stock market. Price return quoted.

- The MSCI ACWI ex-US Index captures large and mid-cap representation across 22 of 23 developed market countries (excluding the U.S.) and 27 emerging market countries. The index covers approximately 85% of the global equity opportunity set outside the U.S. Price return quoted.

- The MSCI Emerging Markets Index captures large and mid-cap segments in 26 emerging markets. Price return quoted (USD).

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s website or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please remember that different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy (including those undertaken or recommended by Company), will be profitable or equal any historical performance level(s). Please see important disclosure information here.