Today we witnessed the largest pullback in the markets since March with the Dow Jones Industrial Average (DJIA) plunging 1,861 points (-6.9%) with growing concerns about recent spikes in new coronavirus cases. The recent resolve that the markets would reopen smoothly was tested and we saw airlines, cruise operators, and retailers suffer the most.

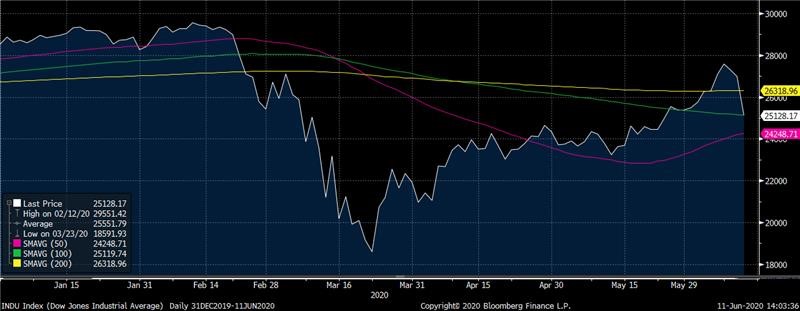

Year to Date Performance of the Dow

While the Dow selloff was forceful, it is not at all uncommon for sharp declines to occur after large rallies. The Dow Jones had been on an upswing of almost 50% in the last 6 weeks. Thursday’s action closed with the DJIA sitting on its 100-day moving average, and we will hope for support at that level. If it were to fail, the 50-day would be the next level we would look to as a cushion (at around 24,250 or about 3.5% from here).

Today was more about testing the psychology in the market as it wrestles with the potential reality that this will linger for a longer period than hoped. We will continue to monitor the growing cases in Texas, Arizona, and California. The reality is that Arizona and Texas did not completely shut down their economies, so it is hard to call this a second wave. We will continue to monitor other indicators but at this point, we do not believe this is a repeat of March, as the world has made tremendous progress since then.