The IRS has identified 21 states that made special payments to taxpayers in 2022. After a review of those special payments, the IRS has determined that taxpayers in many states will not need to report those payments on their 2022 federal income tax returns. Special payments in four of those states should be treated as refunds of state taxes paid, and taxation is determined under the general federal income tax rules for state tax refunds. Special payments in 17 states are treated as made for the promotion of the general welfare or as a disaster relief payment and are excluded from income for federal tax purposes. Illinois and New York are listed in this category but seem to have provided a mixture of payments that fell into multiple categories (see below).

If you have already filed your 2022 federal income tax return and omitted one of these special payments when it was required to be included in income, you may need to file an amended tax return and pay any additional tax due. If you included one of these special payments in income when it did not need to be included, you may need to file an amended tax return in order to get a federal income tax refund with respect to the special state tax payment.

Refund of State Taxes Paid

The IRS has concluded that the special payments from the following states in 2022 are treated as a refund of state taxes paid, and the appropriate analysis under the general state tax refund rules should be made.

- Georgia

- Massachusetts

- South Carolina

- Virginia

Under general rules, if the payment is a refund of state taxes paid, the payment is excluded from federal income tax unless the recipient received a tax benefit in the year the taxes were deducted on the federal income tax return. Thus, the recipient does not need to include the payment in income if the recipient claimed the standard deduction or the taxpayer itemized deductions but did not receive a tax benefit (for example, because the $10,000 tax deduction limit applied) in the year the state taxes were deducted.

General Welfare and Disaster Relief Payments

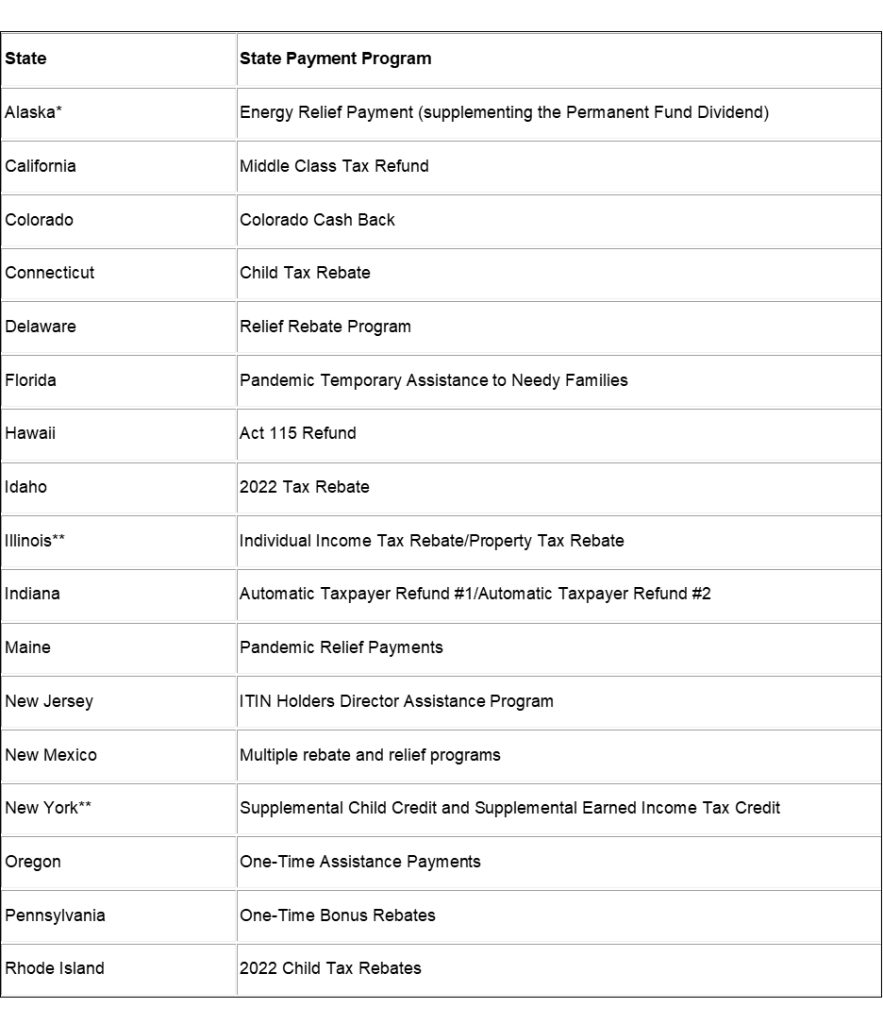

The IRS has determined that the special payments from the following states in 2022 were made for the promotion of the general welfare or as a disaster relief payment and are excluded from income for federal tax purposes.

*Exclusion is only for the supplemental Energy Relief Payment received in addition to the annual Permanent Fund Dividend.

**The IRS stated that “Illinois and New York issued multiple payments and in each case one of the payments was a refund of taxes, which should be treated as noted above, and one of the payments is in the category of disaster relief payment.” It seems that additional guidance from the IRS is needed here to identify the tax treatment of specific payments.

Other Payments

The IRS adds that other payments that may have been made by states (e.g., payments from states provided as compensation to workers) are generally includable in income for federal income tax purposes.

Prepared by Broadridge. Edited by BFSG. Copyright 2023.

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s website or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please remember that different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy (including those undertaken or recommended by Company), will be profitable or equal any historical performance level(s). Please see important disclosure information here.