By: Michael Allbee, CFP® Principal| Senior Portfolio Manager

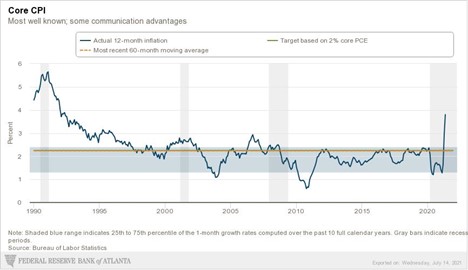

The past few months saw some eye-popping inflation readings after subdued inflation prints last year due to COVID. The Core Consumer Price Index (“CPI”), which excludes the volatile energy and food categories, rose 0.9% in June after increasing 0.7% in May and 0.9% in April, bringing the year-over-year reading to 4.5%. Headline CPI, which includes energy and food, rose to 5.4% year-over-year for the largest 12-month increase since August 2008.

A confluence of events drove these inflation outbursts: 1) the year-over-year inflation readings were expected to jump during the summer due to the low readings a year ago, 2) the speedy rollout of widespread COVID-19 vaccinations in the U.S. and fiscal stimulus unleashed pent-up demand faster than expected, catching many businesses off-guard, 3) the flow of goods ordered from overseas was slowed by shipping bottlenecks including the six-day blockage of the Suez Canal, 4) staffing issues are a contributing factor in the shortages, and 5) other one-off supply constraints (i.e., ransomware attack on a U.S. fuel pipeline, a brutal winter storm knocked out the power grid in Texas, and a global shortage of semiconductors).

Many economists (including those at the Federal Reserve) expect many of these price hikes to be short-lived (“transitory”) as output increases to reduce the bottlenecks. In fact, roughly 90% of the CPI increase was accounted for by reopening price rebounds and supply disruptions. By far the largest contributor to the price rise in that category (accounting for over a third of the increase in the headline CPI) was used car purchases as new car sales were disrupted chip shortages. The other large contributor was transportation services, chiefly airline ticket sales. All the other categories (core services) barely budged. Despite three monthly increases, the 12-month increase in the shelter component, which constitutes nearly a third of the overall index, is still just 2.6%.

And add to this that as the supply constraints ease, year-over-year comparisons to the abnormal pandemic era are subsiding (May 2020 marked the pandemic low in the price index), the $300 federal enhanced unemployment benefit is expiring (many states have already ended it), many employers are re-opening offices, and school will soon be back in session.

However, while inflation might prove to be transitory, the longer-term path of inflation is still unclear and could depend on economic policy decisions yet to be made. Consider this. Inflation has been rising since last June, and yet the Fed has not changed policy one iota. It has been running monetary policy full steam ahead during rising inflationary pressures. Adjusting for inflation, monetary policy has become easier as the real Fed Funds rate (adjusted for inflation) has fallen from -1.1% to -4.4%. This is the result of their new policy framework not to raise interest rates preemptively but to seek maximum employment and deal with inflation later.

Given that “inflation is always and everywhere a monetary phenomenon” as famously said by Nobel laureate Milton Friedman, our goal as your advisor is to construct a risk-appropriate portfolio that will withstand any one of numerous economic scenarios that may unfold, including a scenario of high inflation.

One of my favorite quotes is attributed to Roman philosopher Seneca: “Luck is what happens when preparation meets opportunity.” At BFSG, we had already prepared our portfolio for an inflation scenario before coming into this year by reducing our exposure to long-term bonds, holding Treasury Inflation-Protected Securities (TIPS), initiating and adding to our gold position, holding international stocks denominated in foreign currencies, and having discussions with clients to reduce exorbitantly large cash reserves in low yielding savings accounts. We believe we will have an opportunity as inflation subsides over the next year to build these positions further and possibly add other real assets (i.e., real estate, natural resources, etc.). We believe our portfolios are prepared to meet the opportunity to enable our clients to withstand inflation and other challenges that will inevitably come our way.

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s web site or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please see important disclosure information here.