By: Henry VanBuskirk, CFP®, Wealth Manager

New parents in any country all share a common goal – to have their kids be better off than they were. In America, we colloquially call it ‘The American Dream’. In some respects, the dream is alive and well. In others (budgeting, debt management, and financial literacy in general) it looks more like ‘The American Nightmare’. My goal today is not to pontificate on the efficacy of the recent federal student loan forgiveness plan or recommend we should do X, Y or Z politically (there are plenty of talking heads that do that for us already). My goal is to tell it like it is and have you come to your own conclusions.

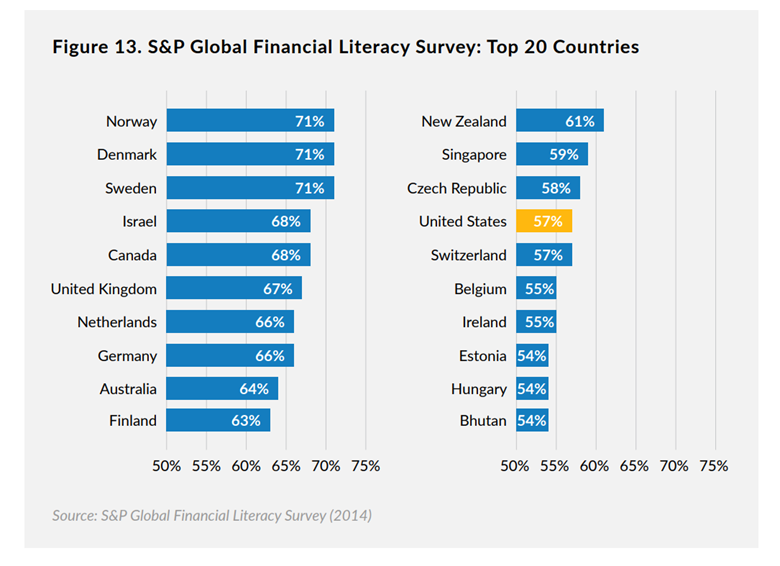

The reality is that the United States is 14th in the world in financial literacy with 57% of adults being considered financially literate, according to the S&P Global Financial Literacy Survey. Fifteen-year-olds generally score average when it comes to financial literacy, and it also isn’t surprising to hear that socioeconomic factors play a role in how well a respondent answers the financial literacy questions.

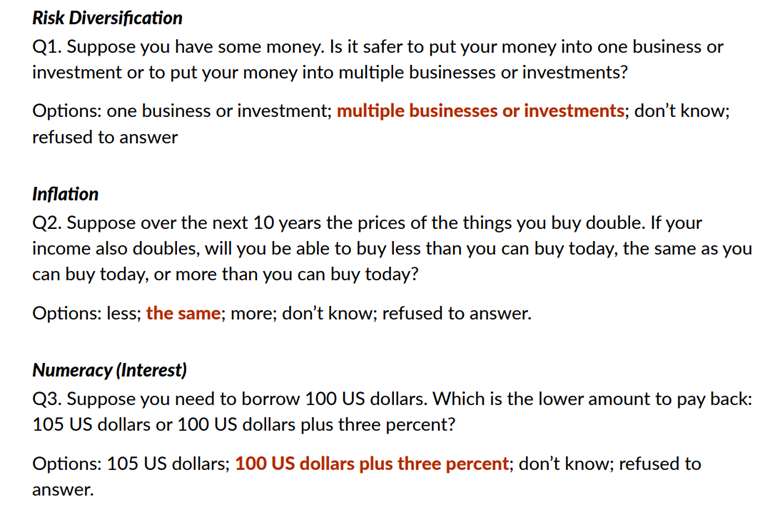

My definition of financial literacy is having a basic understanding of budgeting, saving, investing, and debt management. You may be wondering what kind of questions were asked in this survey and may be surprised when you read them that the questions asked were not trick questions, nor were they at the level of a post-graduate managerial economics class’s final exam. Here were some of the questions asked (correct answers are in red):

With all of the talk about inflation on the news, it’s concerning that 43% of the United States does not understand why having high inflation for too long is a problem in the long term. This begs the question, “How do we get more Americans to become financially literate?”. Adults may want to start reading multiple peer-reviewed sources online to learn the basics on their own and to learn when to ask for help. A good place to start would be our financial literacy webinar series that we did:

- Connecting the Dots to Your Financial Future (Part 1)

- Connecting the Dots to Your Financial Future (Part 2)

- Retirement Plan Basics

We have a robust library of free educational content at BFSG University where you can watch additional webinars, use different calculators (such as mortgage calculators, loan calculators, and savings calculators), and read our other past blog posts. There is also an abundance of free educational content today outside of BFSG if you would like to teach yourself too. Some great websites to get you started are:

- NerdWallet: https://www.nerdwallet.com/

- Bankrate: https://www.bankrate.com/

- Investopedia: https://www.investopedia.com/

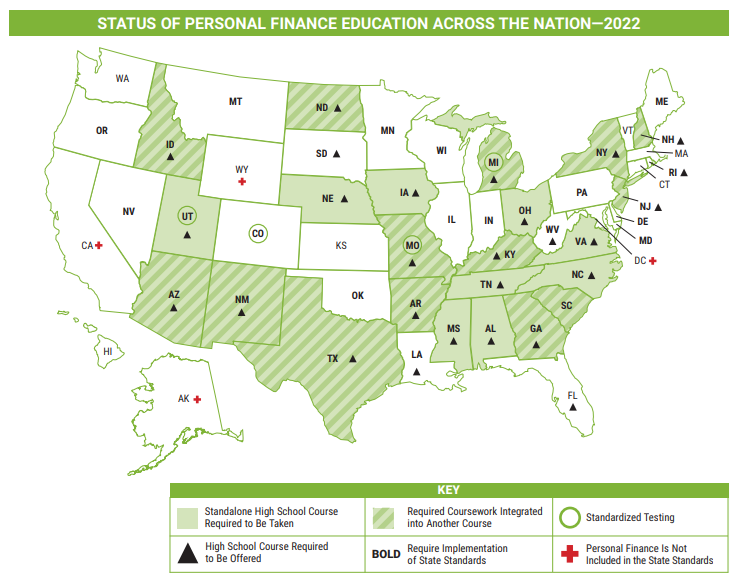

That solves the problem for current adults, but it doesn’t necessarily get to the root of the problem. It would be most beneficial to start learning these topics in our youth. More than half of the states in America do not require a high school course in personal finance to be taken, require coursework integrated with another course, or do not even include personal finance as part of the state standard.

I know Americans are accustomed to seeing a map of the United States shaded in different colors and automatically roll their eyes and think “oh boy, here comes the political argument”. Fortunately for you, I don’t have one. I believe that wanting future generations of Americans to be able to answer questions to real-world problems like, “(1) Should I only pay the minimum required balance on my credit card, or should I pay it off in full every month? (2) Should I contribute to my 401(k) at work and if so, how much should I contribute? (3) Should I buy a home or continue to rent?” is not a political argument. I will say that if your local school system does not require personal finance education, please do your best to teach your kids or grandkids yourself.

I would like to illustrate how this can be done through my financial literacy journey.

My Story:

While I don’t claim to be the omniscient financial guru, I like to think that I am at least financially literate. My journey probably started like most kids. I grew up in the 90s and I had an allowance of $5 per week. My allowance was given to me if I mowed the lawn, took out the trash, cleaned the dishes, cared for our family dog, and didn’t get into any trouble at school. With that $5, I usually bought candy or junk food, nothing worthwhile. I would do the chores weekly, and my dad would usually “forget” to pay me my $5. One time when I was 8, I did my chores for 6 weeks straight and my dad still didn’t pay me for my 6 weeks of work (no I didn’t get in trouble at school). My dad told me to go mow the lawn and I told him, “What’s the point. You haven’t paid me for 6 weeks and you owe me $30. Why would I continue to do work if I don’t know if I’ll get paid or not”. My dad then gave me $30 and said, “What do you want to buy?”. I told him I wanted to buy a $30 video game and my dad then drove me to Best Buy so I could go buy it. After I bought the video game (that I still have more than 20 years later), and got home and started playing it, I realized that I could get things I wanted if I saved my allowance money. A couple of years later, I found out about the stock market and learned that my money can make me money without me having to do anything (except for having a well-thought-out investing process). That journey then led me to the career that I’m in today.

Our team at BFSG is here to help you teach the next generation in your family how to be financially literate and to invest and save for future generations.

Sources:

- https://www.councilforeconed.org/wp-content/uploads/2022/03/2022-SURVEY-OF-THE-STATES.pdf

- https://www.yahoo.com/video/financial-literacy-around-world-top-120017481.html

- https://milkeninstitute.org/sites/default/files/2021-08/Financial%20Literacy%20in%20the%20United%20States.pdf

- https://www.investopedia.com/the-push-to-make-financial-literacy-into-law-4628372

- https://www.investopedia.com/articles/investing/100615/why-financial-literacy-and-education-so-important.asp

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s website or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please remember that different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy (including those undertaken or recommended by Company), will be profitable or equal any historical performance level(s). Please see important disclosure information here.