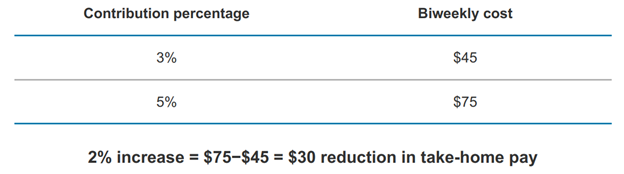

Contributing to your 401(k) may help you build retirement savings over time – without impacting your take-home pay as much as you may think. Consider the hypothetical example below, which shows how a 2% increase in pre-tax contributions could potentially cost you only $30 per paycheck.

Want to learn more about saving for retirement? Visit BFSG University for on-demand webcasts on a wide range of financial wellness topics.

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s website or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please remember that different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy (including those undertaken or recommended by Company), will be profitable or equal any historical performance level(s). Please see important disclosure information here.

*Hypothetical data are for illustrative purposes only and are not intended to represent past or future performance of any specific investment. The balances shown assume a $50,000 yearly salary, a biweekly pay period, a federal tax bracket of 22%, and no state or local taxes.