We typically do not believe in giving blanket advice financial planners because everyone’s situation is different. However, when discussing trusts, we make an exception and have no problem saying that virtually everyone who lives in California should have a trust. A trust is the way to protect your wishes and pass your legacy onto your heirs. Below we will discuss five reasons you should consider using a trust (if you currently don’t have one).

1. Probate is expensive

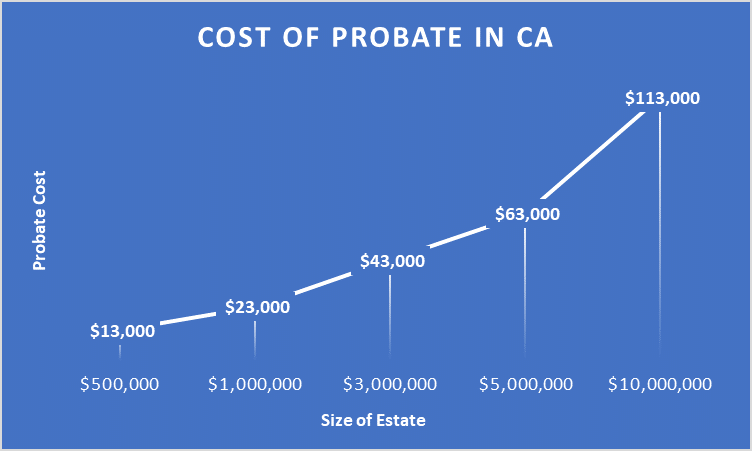

The best and easiest way to avoid probate is with a trust. Without a trust your estate goes to a court so they can essentially distribute your assets to your heirs. Probate is time-consuming since it takes anywhere from nine to eighteen months and is expensive. The chart below shows the costs for probate and does not include attorney fees.

An individual that owns a home for $800,000 and has a $200,000 IRA would have probate fees around $23,000. Paying a few thousand dollars now saves your heirs time and money.

2. Minor children are involved

The best way to protect your minor children is to set up a trust. If there is no trust another adult manages the assets until the child reaches 18 and then the child would have access to all the assets. A trust helps protect the guardian from frivolous spending and can keep an eighteen-year-old from receiving a large sum of money.

3. Effective way to handle complex family situations

Families can be messy or complex. Having a trust will help reduce the potential for family conflict. Too many times estates end up in court because family members can’t agree and file lawsuits. To help illustrate this, in Orange County we currently have a seven-month waiting period for a court hearing.

Aside from family conflict, there may be complex family structures with children from previous marriages. Having a trust in place helps ensure your wishes are met and that the assets go to the correct people.

4. Protecting beneficiaries from themselves

By keeping the assets in trust, you can limit your heirs’ access to their inheritance and protect them from themselves, their potential ex-spouses and creditors.

5. Your privacy is maintained

When using a trust all your information and beneficiaries are kept private. Without a trust it is subject to the courts and becomes public knowledge