(This is the first article in a four-part series)

By: Henry VanBuskirk, CFP®, Wealth Manager

Let me just start off and say that nobody’s perfect or infallible (including BFSG). As a wise man once said, “To Err is Human, to Forgive is Divine”. It is one thing to make a mistake, but another to learn from it. We pride ourselves on working to avoid pitfalls and always being eager to learn. When you’ve been in the financial planning industry as long as we have, we’ve come across mistakes that other advisors have made and we’ve noticed there are some common mistakes and assumptions that are made regularly. Some of these are minor, like not adding accurate cost basis information on a taxable investment account. A major concern like not adding a beneficiary (commonly referred to as Transfer on Death) to an Individual investment account can be harder to forgive, especially if this error is noticed by your would-be heirs after your passing.

The purpose of this article is not to bloviate about how we can do no wrong (last time I checked, pride is one of the seven deadly sins). The point is to show that everyone makes mistakes and for you to be on the lookout for these errors when choosing a financial planner. Anyone can sound convincing if they don’t say um and uh too much and are loud when they talk. The content of the answer is just as important as the delivery method. Sometimes the best answer that you can give someone is an affirmative, “I don’t know, let me get back to you.” Here is an example of what I mean:

Ms. Wilson is 70 years old and wants to withdraw $100,000 from her IRA and have an advisor manage the $1,000,000 account. She is unsure whether or not there is a tax consequence to doing so and decides to meet with three financial planners. Here are those three financial planner’s responses:

- Financial Planner 1 boisterously exclaims, “IRA distributions are tax-free at any age! You have nothing to worry about.”

- Financial Planner 2 meekly remarks, “Based on your withdraw needs, uhh, you … umm will be taxed on your uhhh $100,000 IRA distribution.”

- Financial Planner 3 confidently states, “I don’t know, let me get back to you.” The following day, Financial Planner 3 calls Ms. Wilson back and says, “Your IRA distribution of $100,000 will be taxed at ordinary income tax rates. If you move forward with this distribution, we would like to meet with your CPA to ensure that you withhold the correct amount of federal and state taxes from the distribution. If you do not want the taxes to be paid from the withholding from the $100,000 distribution, we would like you to meet with your CPA to set up a program to pay for quarterly estimated tax payments.”

Based on these responses, which Financial Planner do you believe Ms. Wilson chose to work with? Most likely, Financial Planner 3. Here’s why:

- Financial Planner 1 proves that just because you are loud, you can still be overconfident. If Ms. Wilson tells a friend about Financial Planner 1’s answer and the friend thinks the planner is wrong, Ms. Wilson might check the internet and after a five-minute google search learn that Financial Planner 1 was wrong.

- Financial Planner 2 proves that even though they were correct, Ms. Wilson might interpret the meekly delivered answer as Financial Planner 2 not knowing what the correct answer to her question is. Ms. Wilson might have difficulty discerning the validity of answers given by Financial Planner 2 in the future.

- Financial Planner 3 was honest from the start and then delivered the correct answer while giving supporting details on why the answer was correct.

The goal of this exercise was to show what the very real effects to you can be if you don’t do your due diligence for your investment portfolio and what the effects are to our bottom line if we don’t do ours.

Over this series, we will work through what these mistakes are and how to look out for them.

Return Assumptions

For example, assume Mr. Fox had a meeting with an advisor in December of 2021. When he receives that glossy investment proposal or neatly packaged financial plan, the first question that he should ask is “Are you assuming historical returns, or are projecting future returns based on today’s valuations?” Let’s assume Mr. Fox’s advisor answers, “The S&P 500 has historically averaged 8.16% since 1980. I’ve assumed a rate of 8.16% over the life of the plan”. Now assume that Mr. Fox is an 80-year-old widower with a $1,000,000 S&P 500 Index Account in an IRA and withdraws $80,000 (after-tax) per year (the $1,000,000 account value is after the $80,000 distribution you just took out). This is the only asset that Mr. Fox has. Since he needs this money to live on, he asks his advisor, “Will I have enough money to keep taking $80,000 at the end of each year for the rest of my life?”. The advisor says, “Yes’. Hearing that answer from the advisor, do you believe that it makes sense for him to assume that your $1,000,000 IRA would earn 8.16% forever? The answer is No. Here’s why (all numbers quoted in this section are net after-tax):

2022 rears its ugly head and the stock market is down -19.87% year-to-date. Mr. Fox is worried because of his need to take $80,000 out of the account at the end of each year to fund his living expenses needs every year. Now let’s look at the account value from where Mr. Fox’s advisor assumed he would be versus where he actually is:

- Where the advisor says Mr. Fox would be today: $1,001,600 ($1,000,000 * (1 + 0.816) = $1,081,600. $1,081,600 – $80,000 = $1,001,600)

- Where Mr. Fox actually is: $721,300 ($1,000,000 * (1-.1987) = $801,300. $801,300 – $80,000 = $721,300)

The advisor assumed that since Mr. Fox’s investment account will grow by more than $80,000 per year, since Mr. Fox takes out only $80,000, by default his financial plan is successful. However, looking at where Mr. Fox actually is, you need to take $80,000 off of an account value of $721,300 and you are 81 years old. Now, let’s assume that the markets go through a recession in 2023 and the S&P is down -15% at the end of 2023. At the end of 2023, here’s where the advisor thinks Mr. Fox would have been and where Mr. Fox actually is:

- Where the advisor says Mr. Fox would be in December of 2023: $1,003,330.56 ($1,001,600 * 1.0816 = $1,083,330.56. $1,083,330.56 – $80,000 = $1,003,330.56)

- Where Mr. Fox actually is: $533,105 ($721,300 *.85 = $613,105. $613,105 – $80,000 = $533,105)

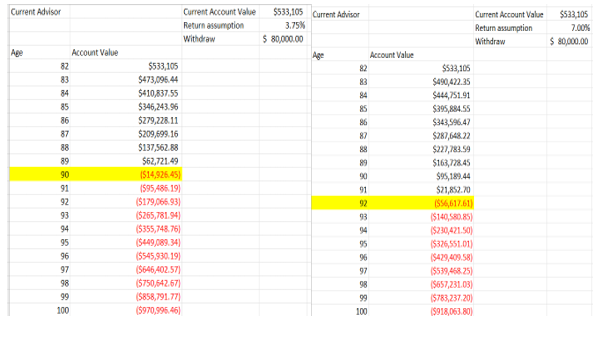

Now Mr. Fox is 82 and very concerned that his investment account was almost cut in half in two years. He isn’t very happy with his current advisor since their assumptions were way off from reality. Mr. Fox decides to meet with another advisor, Mr. Valuation, but also wants to give his current advisor a chance (after all, his current advisor sends delicious cookies to him around the holidays each year). He states his case to both advisors, and they give the following answers to what growth rate to assume for the financial plan and if you will be able to meet your $80,000 yearly distribution for the rest of your life:

- Mr. Fox’s current advisor: “Markets were down in 2022 and 2023, dropping the historical return of the S&P to 7.5%. I will amend the financial plan to reflect this.”

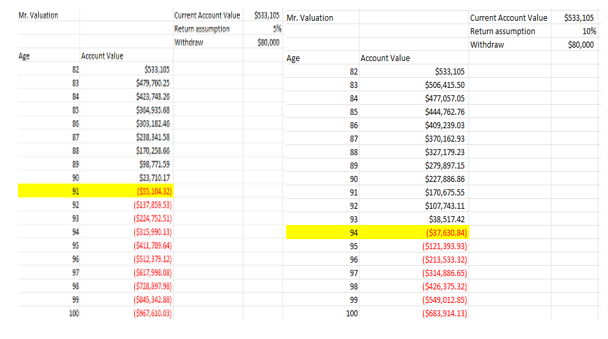

- Mr. Valuation: “Markets are undervalued in our opinion, and we expect a large recovery in 2024. From 2024 until your assumed passing at your age of 100 (2041), we assume a 10% return based on current market valuations.”

Frankly, Mr. Fox doesn’t like either answer. Both advisors’ sense this and they give the following responses:

- Mr. Fox’s current advisor: “I can see that recent market volatility has made you more conservative. You should complete the following risk assessment and we can allocate your portfolio to a more conservative investment allocation of 50% stocks and 50% cash. By doing this, we assume the historical rate in return will be 3.75% instead of 7.5%.”

- Mr. Valuation: “I can see that recent market volatility has made you more conservative. You should complete the following risk assessment and we can allocate your portfolio to a more conservative investment allocation of 50% stocks and 50% cash. By doing this, we will assume a 5% return based on the current valuations of stocks and cash assets.”

Now let’s show why even though both advisors have the best intentions, neither of them will be able to show Mr. Fox a financial plan that works, regardless of whether or not they reallocate his investment account to a more conservative investment portfolio.

Current Advisor:

Mr. Valuation:

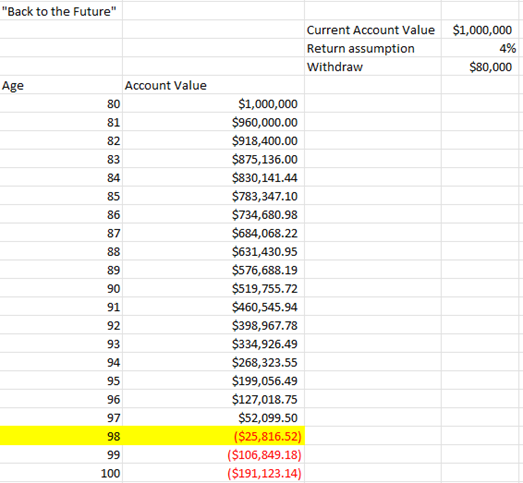

Unfortunately, driving a DeLorean 88 miles per hour to travel back in time isn’t a realistic recommendation (not to mention unsafe) for Mr. Fox. For a moment, let’s say Mr. Fox found a working flux capacitor and could go back in time to December 2021. Now when Mr. Fox hears that answer of “The S&P has historically averaged 8.16% since 1980. I’ve assumed a rate of 8.16% over the life of the plan”, his ears perk up since he now knows that’s wrong to assume. We’re back in time and the account value is $1,000,000. Mr. Fox decides to meet with Mr. Valuation, and they have the following exchange.

Mr. Fox: “Are you assuming historical returns, or are projecting future returns based on today’s valuations?”

Mr. Valuation: “We project future returns based on today’s valuations.” Since we believe that the market is overvalued, we believe that the S&P will be down anywhere between 10-15%. We also recommend that you reallocate your investment portfolio to 50% stocks and 40% bonds and 10% cash. Based on this allocation, we assume that your portfolio will be down -10% in 2022, -5% in 2023, and then earn 4% from 2024 until the end of the financial plan.

Mr. Fox: “That sounds reasonable, can you prepare a financial plan for me?”

Mr. Valuation: “I would be happy to.”

Below are the results of that plan:

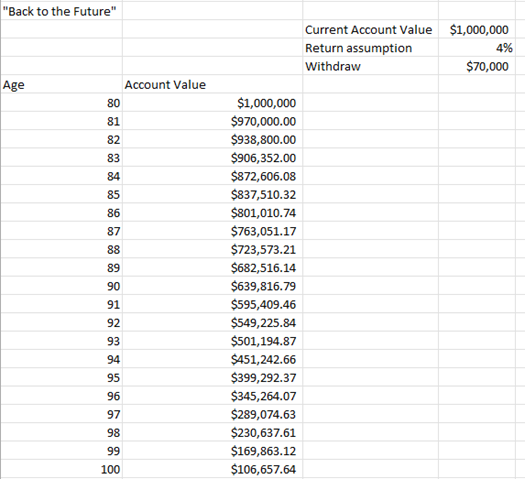

Even though the plan does not make it to Mr. Fox’s age of 100, at least knows ahead of time that the assumptions allow the plan to last to his age of 98. Mr. Valuation says not to worry, since we can still reduce your annual distribution to $70,000 to make the plan last to age 100.

Here is the summary of that plan:

As a satisfied time traveler, Mr. Fox decides to stay in this timeline where he didn’t lose half of his money in two years.1

However, you as an astute reader might be thinking, “Well this is nice to know, but markets don’t return exactly 4% every year.” Mr. Fox then turns to Mr. Valuation and asks, “What does the plan look like assuming returns the next few years are bad, but the plan still averages 4% per year? How about if the plan starts off good, but the plan still averages 4% per year?” Unfortunately, Mr. Valuation isn’t sure.

Mr. Fox decides to take the work that Mr. Valuation has done and find a different advisor who can help answer his questions. Fortunately, Mr. Fox finds another advisor, Ms. Sequence, who can answer his questions and will lead us to the next concerning mistake, if not addressed properly, Sequence of Returns Risk. Unfortunately, you’ll need to wait until the next post to read the next installment of this series.

Footnote:

- Doc Brown and Marty McFly are not clients at BFSG, and we do not have a working flux capacitor.

Disclosures:

Past performance is no guarantee of future results. Different types of investments involve varying degrees of risk. Therefore, there can be no assurance that the future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Benefit Financial Services Group [“BFSG”]), or any consulting services, will be profitable, equal any historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. BFSG is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. Moreover, you should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for, personalized investment advice from BFSG. A copy of our current written disclosure Brochure discussing our advisory services and fees is available upon request or at www.bfsg.com. The scope of the services to be provided depends upon the needs and requests of the client and the terms of the engagement. Please see important disclosure information here.

Please Note: The above projections are based upon historical data and should not be construed or relied upon as an absolute probability that a different result (positive or negative) cannot or will not occur. To the contrary, different results could occur at any specific point in time or over any specific time period. The purpose of the projections is to provide a guideline to help determine which scenario best meets the client’s current and/or current anticipated financial situation and investment objectives, with the understanding that either is subject to change, in which event the client should immediately notify BFSG so that the above analysis can be repeated.