By: Michael Allbee, CFP®, Senior Portfolio Manager

We sit here today, reflecting on the recent bull market in stocks, bonds, and housing. The Federal Reserve Chairman, Jerome Powell, gave a dovish speech last week and didn’t give a timetable “to take away the punch bowl” and the bull market party continues.

As the ex-Citigroup CEO, Chuck Prince, stated, “When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you’ve got to get up and dance.” But we prefer the Deep Thought by Jack Handey, “Let’s be honest: Isn’t a lot of what we call tap dancing really just nerves.”

While I dance with my nerves, I know by following time-tested investment strategies, keeping my emotions in check, and by having a long-term plan, the likelihood of positive returns grows even if there is a forthcoming market decline. By succumbing to short-term strategies such as market timing or performance chasing, many investors show a lack of knowledge and/or ability to exercise the necessary discipline to capture the benefits markets can provide over longer time horizons.

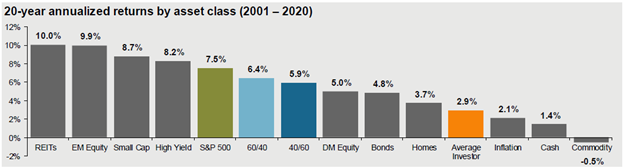

This lack of discipline has cost the average investor many thousands (sometimes hundreds of thousands) of dollars over a lifetime compared to other asset classes over the last 20 years, according to Dalbar Inc. (See Chart) According to Reuters, the average holding period for U.S. stocks today is around 5 ½ months. No wonder why the average investor is their own worst enemy.

Even the average homeowner gets the importance of time in the market rather than timing the market. Most homeowners tend to stay in place for at least eight years, according to DataTrek (*note – the illiquid nature of homeownership and tax benefits partly explain the longer holding period). The average eight-year period compound annual growth rate (CAGR) for a homeowner is 3.7% – note this is higher than the average investor return of 2.9%.

Author Carl Richards states, “We’re wired to avoid pain and pursue pleasure and security. It feels right to sell when everyone around us is scared and buy when everyone feels great. It may feel right – but it’s not rational.” Market timing easily plays on our emotions in a way that overrides even the most well thought out plans. But if you stay calm, you’ll find that the likelihood of a positive return grows higher the longer you stay invested. Having a long-term plan, one that can work through market volatility, is one of the best ways to pursue your long term goals and bolster your financial situation for years to come.

If you don’t have a long-term plan or are feeling nervous about the markets, we recommend you first start by determining how much risk you are willing to accept. Take our free risk analysis. From there we can continue the conversation in helping you create a long-term plan.

- Indices used are as follows: REITs: NAREIT Equity REIT Index, Small Cap: Russell 2000, EM Equity: MSCI EM, DM Equity: MSCI EAFE, Commodity: Bloomberg Commodity Index, High Yield: Bloomberg Barclays Global HY Index, Bonds: Bloomberg Barclays U.S. Aggregate Index, Homes: median sale price of existing single-family homes, Cash: Bloomberg Barclays 1-3m Treasury, Inflation: CPI. 60/40: A balanced portfolio with 60% invested in S&P 500 Index and 40% invested in high-quality U.S. fixed income, represented by the Bloomberg Barclays U.S. Aggregate Index. The portfolio is rebalanced annually. Average asset allocation investor return is based on an analysis by Dalbar Inc., which utilizes the net of aggregate mutual fund sales, redemptions and exchanges each month as a measure of investor behavior.

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s web site or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please see important disclosure information here.