By: Tina Schackman, CFA®, CFP®, Senior Retirement Plan Consultant

With approximately 94% of American workers covered by Social Security and 65.2 million people currently receiving benefits, keeping Social Security healthy is a major concern.1 Social Security isn’t in danger of going broke since it’s financed primarily through payroll taxes, but the financial health of the Social Security trust fund is declining, and benefits may eventually be reduced unless Congress acts.

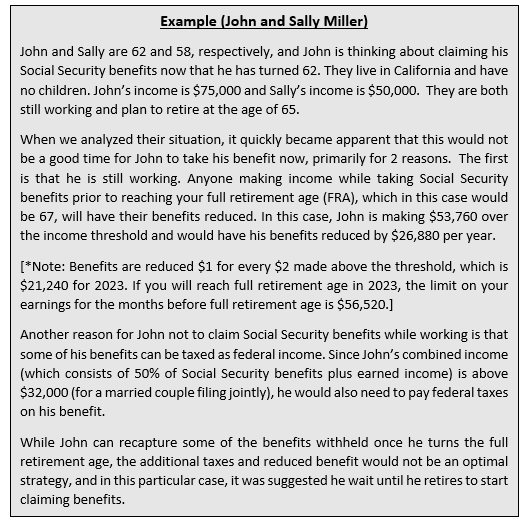

This could be a reason so many U.S. workers are asking whether they should take Social Security benefits as soon as they turn 62. In fact, in 2021, 25% of men and 27% of women filed for their Social Security benefits when they turned 62, but is this the right strategy for you? Well, it depends on your specific situation. There are many variables that can help or hurt your outcomes when it comes to maximizing your benefit. Let’s walk through a sample client to illustrate a specific Social Security filing recommendation.

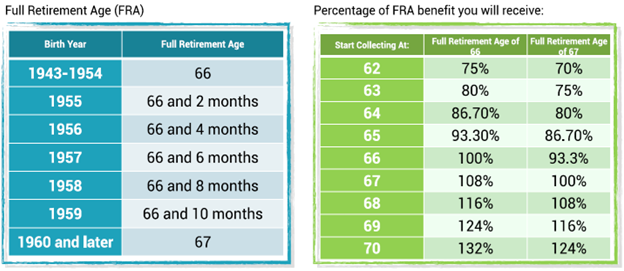

The graph below shows the percentage of the FRA benefit you will receive, but it’s important to note there can be adjustments if you have earned income while claiming your Social Security benefits.

Another question that came up in this example was if John could invest his Social Security benefits into an IRA or Roth IRA. Because Social Security benefits are not considered earned income, they cannot be used to make contributions into your IRA accounts; however, John and Sally can both make contributions into their IRA accounts with their earned income.

Everyone’s situation is going to be different, especially when there is a spouse involved, so it’s best to speak with an advisor or call the Social Security Administration office to understand your options. And we highly encourage you to do this well in advance of turning age 62 so you can have a well-thought-out strategy for your retirement.

Footnotes:

- Source: www.ssa.gov (December 2021)

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s website or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please remember that different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy (including those undertaken or recommended by Company), will be profitable or equal any historical performance level(s). Please see important disclosure information here.