When there is so much liquidity sloshing around the system, Wall Street always comes up with a way to capitalize with a bit of financial engineering. The latest soup de jour is a special purpose acquisition company (“SPAC”). A SPAC is a “blank check” company that raises money in an Initial Public Offering (“IPO”) to merge with a privately held company that then becomes publicly traded as a result with the SPAC shareholders getting shares in the new combined company. In other words, it basically involves handing over money in something of a blind faith investment.

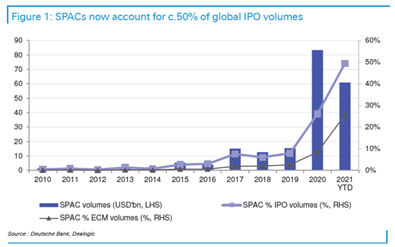

SPACs raised a record $82 billion last year and they now make up 50% of all IPO volumes which speaks to the current frothy investing environment.

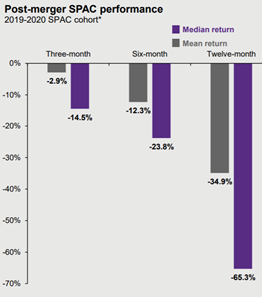

Who is benefiting from this SPAC-hype? It is rarely the Main Street mom and pop investor. The post-merger SPAC performance is typically dismal as we can see.

*Latest SPAC included in cohort is from June 2020. Data is based on availability as of February 28, 2021.

The Wall Street investment bankers and hedge funds are the real winners – at least until the music stops. SPACs pay bankers for going public and for negotiating mergers, pay sponsors (those who set-up the SPAC and find the merger target) typically 20% of their stock, and then there is dilution on top of that due to redemptions of warrants. If you want to dig deeper into the high costs of SPACs, we recommend you take a look at “A Sober Look at SPACs” by Michael Klausner of Stanford and Michael Ohlrogge of New York University, which is summarized here.

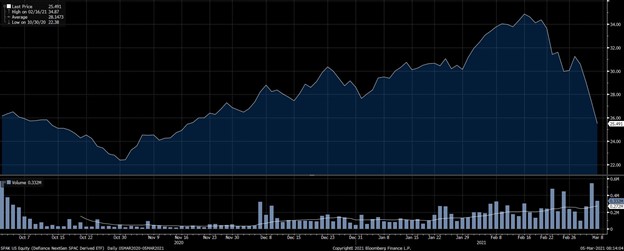

We believe this speculative behavior from the r/wallstreetbets movement to Bitcoin and from tech to SPACs, is due to the extraordinary amount of money sloshing around the financial system. As bond markets have flashed a warning sign, we have seen SPACs fall about 25% since their February peak. Is this a precursor of what is to come for some of these speculative investments?

With more stimulus forthcoming from the fiscal side of the government, speculative behaviors could drive these types of investments higher in the short run. As the former Citigroup CEO, Chuck Prince said “When the music stops, in terms of liquidity, things will be complicated, but as long as the music is playing, you’ve got to get up and dance.” Sorry, Chuck, BFSG is not getting up to dance to this speculative behavior. We continue to firmly believe that the best remedies to an uncertain world are fundamental analysis, appropriate asset allocation, broad diversification, disciplined rebalancing, and cost minimization.

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s web site or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please see important disclosure information here.