By: Michael Allbee, CFP®, Senior Portfolio Manager

There are many tax strategies available for business owners, but it requires proper planning throughout the year. Here are some things to consider as we approach the year-end to minimize your tax liability.

Take advantage of the expiring “Tax Cuts and Jobs Act” (TCJA) bonus depreciation

In 2017, the TCJA made it so business owners could deduct 100% of qualifying business property (i.e., new equipment, auto above 6,000 lbs., etc.) in the first year it was put to use. However, this regulation is expiring in 2022, and by 2023, owners will only be able to deduct 80% of qualifying properties within the first year of investment. Then, the percentage drops by 20% each following year. If you need to purchase business-related property, now is the time to do it.

Defer revenue and accelerate expenses (or vice versa)

Many small businesses use the cash method of accounting on their books and tax returns. Under the cash method, a company recognizes income when it’s received and expenses when paid — in other words, when cash actually changes hands. That creates some interesting tax planning strategies.

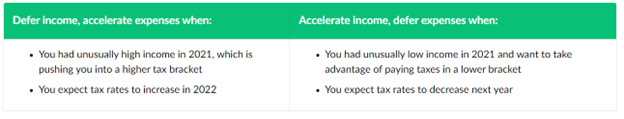

If you expect to be in a lower tax bracket next year, you might want to defer income to next year, when you’ll pay taxes at a lower rate. The same concept works with expenses. If you’re in a high tax bracket this year, you might want to accelerate expenses in 2022 to reduce your taxable income.

On the other hand, it might make more sense to accelerate income into this year — especially if you think tax rates will increase in the near future. In that case, you might want to send your invoice and try to collect payment from your client in 2022, so more income will be taxed at your current tax rate.

Here’s a handy guide for when to accelerate or defer income and expenses.

Consider the following strategies for executive compensation such as stock options

- Consider the timing of non-qualified stock option (NSO) exercises to fill lower marginal tax brackets.

- Consider qualifying disposition of incentive stock options (ISOs) for potential long-term capital gains treatment.

- Consider disqualifying disposition or tandem exercise of ISOs to avoid the alternative minimum tax (AMT).

Take advantage of the home office deduction (if you qualify)

If you have a home office, you may be eligible to deduct direct and indirect expenses for your home office. What can you deduct if you qualify? Read further here.

Use required minimum distributions (RMDs) to pay estimated taxes

Business owners typically pay quarterly taxes. For those that want to pay as late as possible, instead of quarterly taxes, you can have money withheld from IRA distributions to pay for taxes.

Take full advantage of tax-advantaged retirement accounts

Set-up or contribute to a retirement account. Deductible contributions to a retirement account such as an individual 401(k), SEP-IRA, or SIMPLE IRA can reduce your 2022 taxable income. Contributing to your retirement accounts may help you build retirement savings over time – without impacting your take-home pay as much as you may think.

Make charitable contributions

If you are charitably inclined, you should plan your donations in advance to ensure you maximize the tax benefits. The most common way to make a charitable gift is with cash. This works fine for smaller gifts (think one-time small charitable donations) but for larger charitable gifts there might be better alternatives to consider. Consider gifting appreciated assets or gifting from your IRA (Qualified Charitable Distributions).

If you’d like to learn more about tax planning strategies unique to your business, feel free to Talk With Us!

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s website or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please remember that different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy (including those undertaken or recommended by Company), will be profitable or equal any historical performance level(s). Please see important disclosure information here.