The Senate finally passed the $2 trillion relief package referred to as the CARES Act after some delays and theatrics. When you factor in the loans and other parts, the relief package total is over $6 trillion. The main part of the $2 trillion relief package represents about 10% of our GDP. This is a very large bill with over 850 pages, so there is a lot to unpack. Let’s break down this relief package to understand how this will impact you.

Coronavirus Aid

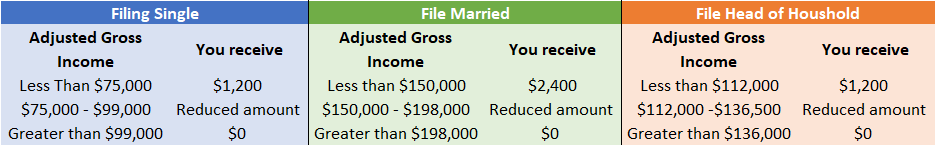

Money will be received by everyone qualifying based on the gross adjusted income of your 2019 tax return, or your 2018 return if you have not yet filed, which should be the case for most people. Below is a chart of how much to receive based on tax filing status and adjusted gross income.

In addition, you should receive an additional $500 per child under the age of 17. Most checks will be sent via direct deposit based on the bank account used for your tax returns and the rest will be mailed.

Additional Unemployment Benefits

Unemployment benefits have been expanded and will cover self-employed individuals and independent contractors. Unemployment benefits will be increased by $600 per week in addition to the normal unemployment benefit for up to four months. The length of time an individual can receive unemployment was extended as well.

No RMDs for 2020

Any individual who would normally be subject to taking a Required Minimum Distribution (RMD) for 2020 will no longer have to for 2020, based on the new bill. This applies to any individual that has an IRA, 401(k), 403(b), 457(b), SEP-IRA, SIMPLE IRA and inherited IRA. This change DOES APPLY to anyone that turned 70.5 in 2019 and delayed their first RMD till 2020, so no distributions are needed, and delaying in this instance is rewarded.

Easier Access to Retirement Accounts

Those under age 59.5 impacted by COVID-19 can take hardship distributions in 2020 of up to their entire account balance or $100,000 (whichever is less) from 401(k)s or IRAs, without being charged the 10% early-withdrawal penalty or mandatory withholding requirements. The income for tax purposes will be spread over three years unless you choose to include it all in 2020. The great part is individuals will have up to three years to repay this distribution if they choose (in effect, having treated it as a loan). The advantage of repaying the distribution is it would substantially reduce the tax impact, and you can even amend returns to get a refund after repaying the amount!

Many employer-sponsored plans, like 401(k)’s, offer employees the ability to take out loans against their retirement accounts. The annual cap on loans from such plans was increased to $100,000 or 100% of the plan balance, whichever amount is smaller. Currently, plan borrowing is limited to $50,000 or 50% of the vested account balance, whichever is less. The repayment of these loans can also be delayed up to one year. This is another potential way to access cash if needed, without paying taxes if the loan is repaid.

Changes to Charitable Gifting

For those who are charitable minded, there is a large increase in the tax-deductibility of charitable gifting. For 2020, cash gifts made to charities can now equal 100% of Adjusted Gross Income (AGI). These charitable contributions CANNOT be used for Donor Advised Funds or 509(a)(3) supporting organizations. Normally the limit is 60% of AGI, so a person with a $200,000 AGI can now deduct up to $200,000 if charitable gifting is made in cash, where normally they would be capped at $120,000 (60% limit).

Delay Student Loans

Individuals with student loans do not have to make any payments until September 30th and the loans will not accrue any interest during this time. If you wish to take advantage of this, you must be proactive and contact your loan provider since voluntary payments are still allowed. Most collection efforts will be suspended during this time, as well. For 2020, employers can pay up to $5,250 of student debt without it having to be included in the employee’s income.

Updates to Health Care Benefits

All tests for coronavirus must be covered by your insurance. Over the counter medicine and feminine healthcare products are now qualified expenses for Health Savings Accounts and Medical Savings Accounts.

Tax Credit for Retaining Employees

A new Employee Retention Credit has been created that is worth up to 50% of the qualified wages paid for each employee. To qualify there are several factors that include:

- Business operations were partially or fully suspended due to COVID-19

- Gross revenue is less than 50% of revenue in the same quarter vs. the prior year.

There are many layers to this credit so please work with your tax advisor for more information.

Forgivable Small Business Loans

Part of the CARE Act includes the Paycheck Protection Program. This is a partially forgivable loan through the Small Business Administration (SBA) and will be available through SBA lenders. Qualifying businesses include sole proprietors with fewer than 500 employees (or employee size standard under NAICS Code if over 500 employees). The loans will be for the lessor of $10 million- or 2.5x the average payroll costs over the last year at a rate no greater than 4%, with terms up to ten years. The loan may be forgivable based on how the proceeds are used and the number of employees retained.

Businesses May Defer Payroll Taxes

Businesses will be allowed to defer payment of payroll taxes for 2020 over a two year period with 50% due December 31, 2021 and the remaining 50% by December 31, 2022

Net Operating Loss Rules

Now corporations (excluding REITs) with Net Operating Losses (NOLs) from 2018,2019 or 2020 can now be carried back for up to five years. NOLs now can be used to offset 100% of taxable income for 2018, 2019 or 2020 (previous rules were capped at 80%).