By: Paul Horn, CFP®, CPWA®

You do not have to turn on the news to know that many in the world are hurting. There is a greater need for charitable giving today than any time I can remember and there are so many different causes that need support. The most common way to make a charitable gift is with cash and this works fine for smaller gifts (think one-time small charitable donations) but for larger charitable gifts there may be better alternatives to consider.

Gifting Appreciated Assets

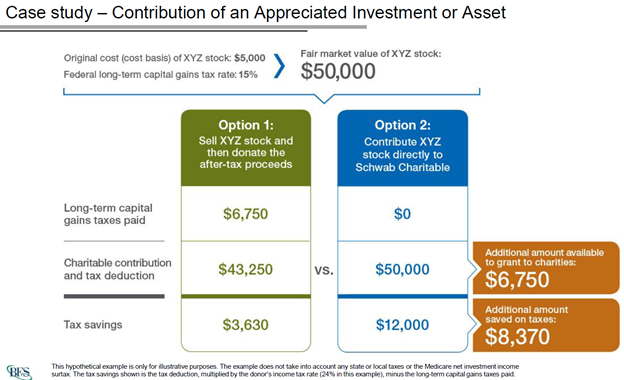

There are several tax benefits of gifting stock instead of cash. We are amidst the longest bull market on record, and many have large gains in their taxable accounts. If you gift appreciated stock you don’t have to pay taxes on the gains of the stock and you still get credit for the total gift if you itemize your deductions. Let us take a look at an example below:

You can see in this example gifting appreciated stock instead of cash can save the person over $8,000 in taxes. Even for smaller gifts, this strategy can still be very effective!

Gifting From Your IRA

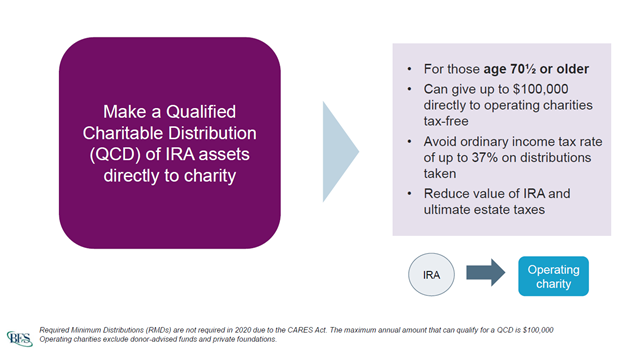

Did you know you can make gifts out of your IRA? This strategy is called a Qualified Charitable Deduction (QCD) and often is better than gifting cash. The IRS allows QCDs up to $100,000 per year and the amount you gift decreases your Required Minimum Distribution (RMD) by the same amount. For example, if you have an RMD of $20,000 for the year and use a QCD of $12,000, all you are required to take for the RMD is $8,000. You do not pay taxes on the QCD amount (in this example $12,000).

If you are 72, own an IRA, and donate to charities, QCDs may make sense for you. If you would like to learn more about charitable gifting please check out our webinar. As always please consult with us or your CPA before implementing these or other strategies.

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s web site or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please see important disclosure information here.