Author: Andrew Donahue, CFP®

Some of our clients are the best physician anesthesiologists in medicine. They also make for some of our best wealth accumulators. Here are eight reasons why.

1. They understand the importance of takeoff and landing.

For many physician anesthesiologists, their money is made when they start and when they finish (during induction and emergence). That’s not to say time in between is a lull. Patient complications and emergencies are commonplace. Typically, however, the most consequential anesthetic planning and judgment is rendered at the beginning and at the end of each episode.

The same general sequence follows for their wealth management. We see our clients realizing that the most meaningful and impactful financial decisions they can make is usually (i) when we first establish their financial plan (and implement changes immediately thereafter), and (ii) as we start to “land the plane” for their retirement.

In hindsight, they often admit they had no clue how much wealth they could maximize during the entry and exit phases (“but I’m glad I listened”).

2. They read people well.

By necessity, physician anesthesiologists tend to specialize in first impressions. Sometimes, they only have a few minutes to greet a patient, assess a psychosocial profile, and/or establish a physiological baseline. Other times, they are managing distracted surgeons, exhausted clinical teams, and out of touch administrators. Human nature becomes a realm of professional expertise.

For our clients, this skillset is useful as they approach the financial services industry. As with anesthesiology teams, there are good wealth management teams and bad wealth management teams. The American Society of Anesthesiologists recommends using a “fee-only fiduciary” (legally bound to act in your best interest). It’s also recommended that any such fiduciary be a Certified Financial Planner™ (professionally bound to take a holistic approach to your financial life).

Beyond these two fundamental first steps, our clients seem to avoid trouble by simply asking questions and trusting their gut.

3. They “get” the importance of breadth of knowledge.

Physician anesthesiologists are true medical experts. Dr. Henry Jay Przybylo, physician anesthesiologist and author of Counting Backwards, describes it well:

“Anesthesiology allows little of what was learned in medical school to be forgotten. Perhaps no other specialty remains as expansive or inclusive, covering all the basic sciences (anatomy, pathology, physiology, pharmacology) and all fields of clinical medicine (internal medicine, surgery, pediatrics, obstetrics, and even psychiatry)… On any given day, any page of the physiology, pathology, or pharmacy texts may need to be scoured for a reference…

…[Until] I’m assured my patient has returned to a state of comfort and is prepared to reunite with loved ones, I am the primary care physician. During my anesthesia care, I become the internist, the ob-gyn, the pediatrician. The child scheduled to have a skin mole removed might have a failing heart; the woman whose brain aneurysm has burst might also suffer the pain and deformities of rheumatoid arthritis. When things take a turn for the worse during a procedure, when the blood loss climbs or the heart rhythm goes awry, it’s left to the anesthesiologist to make life right.”

When our clients select a wealth manager, we can’t help but notice they tend to look for someone with breadth of knowledge. They seem to “get” that wealth accumulation is about much more than investing and stock-picking (just as anesthesia is about so much more than putting people to sleep). It’s investing, yes. It’s also tax avoidance, retirement planning, Medicare and Social Security planning, benefits selection, education planning, health care expenses, budgeting, purchase decisions, cash management, credit cards, estate planning, insurance planning, liability protection, asset protection, gift strategies, debt repayment, wills, trusts, incapacity planning, financial aid, credit management, student loans, charitable giving, and legacy planning. Not one of which any wealth manager can address without considering the effects on the others.

They tend to look for a professional who treats the financial organism as a whole, not just one cell or one part.

4. They want to be hands-on.

Every day, physician anesthesiologists care for sick patients and save lives. Sometimes, they are the actual healers themselves. It’s an intentional level of involvement they chose early in their medical careers (procedural care versus academic treatment). In particular, applied clinical pharmacology is a passion – administering medication, observing changes, and responding in real-time.

Our clients tend to approach their relationship with wealth management the same way they approach their relationship with medicine. They don’t sign up and disappear. They want to be involved. They schedule regular meetings. They look to understand the methods and recommendations. They aren’t interested in the minutiae, but they want to see how the work moves the needle in real-time.

This kind of active client engagement always (always) improves the outcome. If you can think back to your last “dream” patient or surgical case, for us it feels something like that.

5. They make decisions under pressure.

When something goes wrong, a good physician anesthesiologist brings leadership and composure to the operating room. If a patient is crashing, they don’t hesitate to step in and stabilize the table – regardless of who’s in the room.

Our clients tend to bring the same bias for action to their financial life. They have confidence in their financial plan (which they had a hand in creating) and they trust the science and math behind it. If something unexpected happens, they calmly reflect on the facts and make appropriate changes. Because their reactions are always measured and controlled, they rarely suffer any self-inflicted financial wounds.

6. They deftly navigate the unknown.

Still today, there is so much science cannot explain about consciousness and memory (let alone, how gas impacts one but not the other). Despite decades of research, the mechanism of action remains one of neuroscience’s greatest mysteries. Yet, the absence of absolute knowledge and control of anesthesia does not preclude physician anesthesiologists from applying it to save lives.

This familiarity with the unknowable tends to help them avoid mistakes in their financial life. We all fear market volatility, for instance, but that doesn’t mean we bury money in the backyard. We choose to invest as a counteroffensive to inflation. Not one of us knows how much we will spend in our life – or how long it will go – but we make careful sacrifices and choices now to be ready for different scenarios.

Many realize quickly that the appropriate response to the financial unknowns of life is moderate conservatism – not extremism.

7. They cope with reality.

Literally and figuratively, physician anesthesiologists confront reality on a daily basis. They erase consciousness, eliminate pain, remove time, deny memories – all in the name of extending human life. What’s more? They accomplish all of this while their specialty, profession, and practice is assaulted with bureaucracy and distraction (MIPS, MACRA, PPACA, bundled payment programs, reimbursement cuts, industry consolidations, patient satisfaction ratings, quality scores, insurance denials, administrators, billing regulations, contractual arrangements, clinical guidelines, professional liability claims, electronic health records, increasing caseloads, unpredictable shifts, CRNAs, outdated drugs, etc.).

Not surprisingly, physician anesthesiologists face some of the highest burnout rates in medicine (often ranked just behind emergency medicine, critical care, and family medicine).

As exhausting and disheartening as it can be, we find our clients do well to prevent their emotions from draining their energy. Instead, they keep a sharp focus on what they can impact and control: (i) keeping their profession and practice solvent, and (ii) maximizing professional income while it’s available. Mentally, they describe anything else to us as a “waste of time.”

This mindset and pragmatism is usually what brings them to us in the first place. Yes, they possess the intellectual horsepower to learn and master finance, taxation, and the markets (and more). What they tell us is simple, “All of those hours I’d be planning and day-trading, I can sell to medicine for a lot more.”

8. They want to find balance.

Every day, physician anesthesiologists balance their patients’ needs. They control awareness and responses to pain, adrenaline and blood flow, and memory and muscle tone. They assess and re-assess what needs to be done to make sure every episode of care is a “non-event” for the patient who entrusts them with their life.

We often notice, as soon as our clients begin to see plan progress and feel more confident about their financial path, they start to apply the same calculus and thoughtfulness to their own life. They start to tell us they value balance more. They start to express more gratitude for what they have. More appreciation for those in their life. More positivity about their future and their place in the world.

Here is what’s fascinating.

Usually, right about when they move to an abundance mentality is about when they start to see their wealth take off. Not unlike anesthesia – one of the biggest mysteries of neuroscience – it’s a phenomenon of wealth accumulation we cannot fully explain.

Andrew Donahue, CFP® is a financial planner and wealth manager at Benefit Financial Services Group (BFSG) in Irvine, CA. Prior to a career in private wealth management, Andrew served as a congressional aide and a hospital executive. He can be reached at andrewd@bfsg.com.

Please see important disclosure information here.

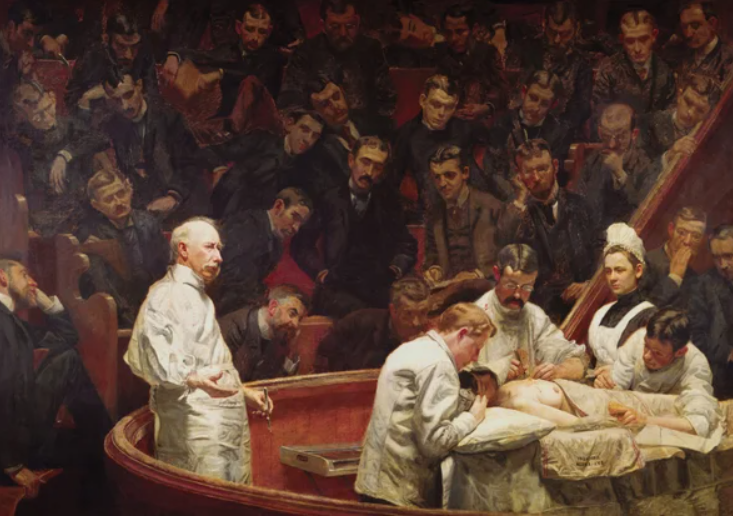

*This is a faithful photographic reproduction of a two-dimensional, public domain work of art. This photographic reproduction is considered to be in the public domain in the United States. This file has been identified as being free of known restrictions under copyright law, including all related and neighboring rights.